As one of the favorite cryptocurrencies, the price condition of Ethereum (ETH) in 2024 will still make many eyes turn.

Even though Bitcoin is indeed the hot topic in Q1 2024, it cannot be denied that many investors are looking forward to a significant increase in the price of Ethereum in the crypto market.

This may happen sooner than expected, especially considering a series of important events that will have a major impact on the Ethereum (ETH) ecosystem as a whole.

Therefore, in this article we will discuss in depth the changes that have occurred and will come, as well as investment tactics that can be adopted based on these changes.

Daftar Isi.

Update on market conditions and important events for Ethereum 2024

Even though only three months have passed in 2024, many events have occurred in the crypto world which have already had a significant impact on the value of the cryptocurrency market as a whole. Especially for Ethereum, here are the latest and upcoming conditions for this cryptocurrency this year.

Ethereum: No Longer a Mainstay Smart Contract Provider?

Although the price performance of Ethereum (ETH) in February – March 2024 was actually quite good, even briefly reaching $4,000 per coin on March 9 2024, it cannot be denied that this increase was largely due to Bitcoin's performance which far exceeded many people's predictions and increased optimism for the crypto market as a whole.

Then, why is the performance of Ethereum (ETH) in Q1 2024 itself more sluggish compared to Bitcoin? One of them could be the increasingly fierce competition between Ethereum and alternative cryptocurrencies that also offer features smart contracts like Solana (SOL).

The main problem with Ethereum (ETH) is gas fees which continues to increase and far exceeds the costs set by its competitors.

As of March 9 2024, it has been reported that Ethereum gas fees had reached $28 per transaction.

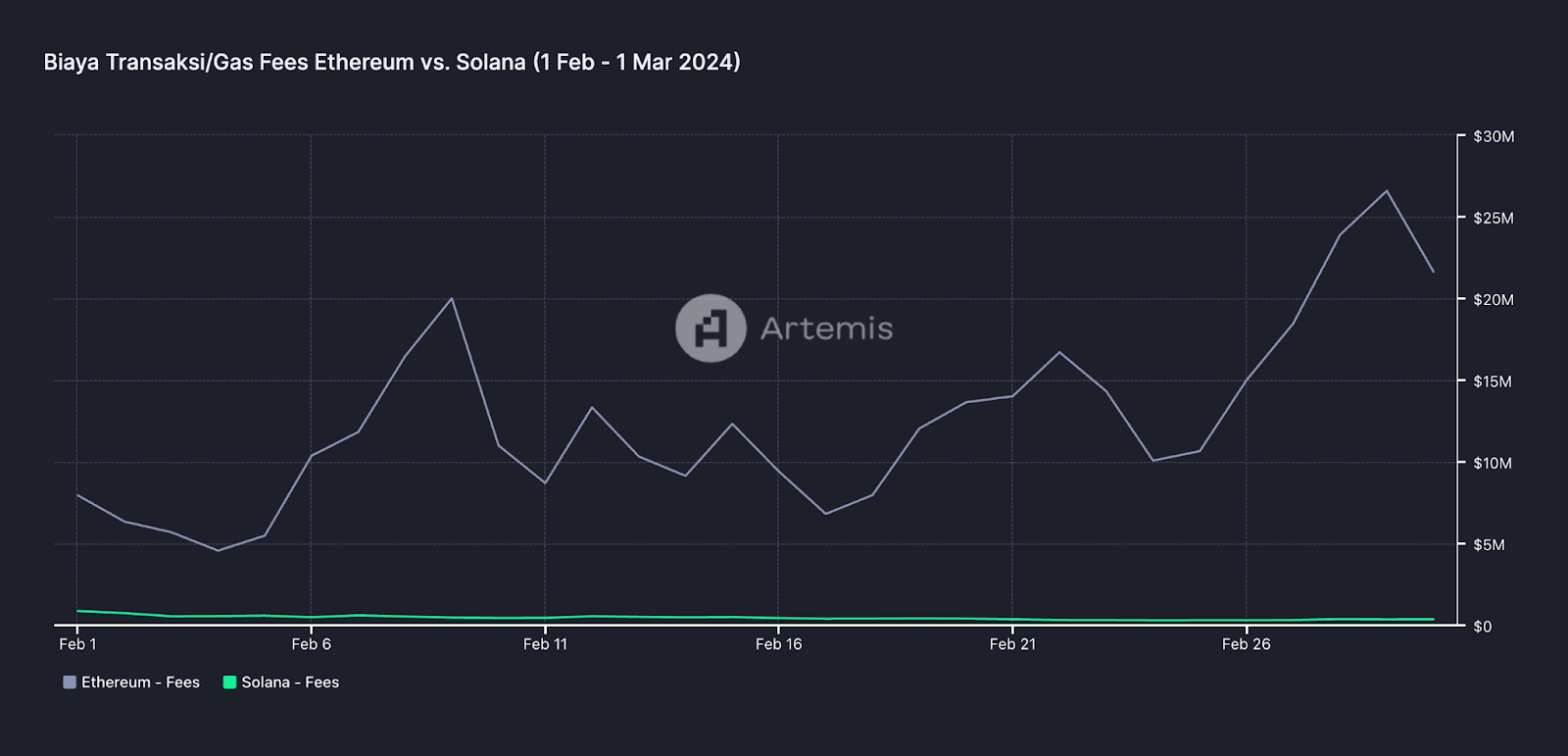

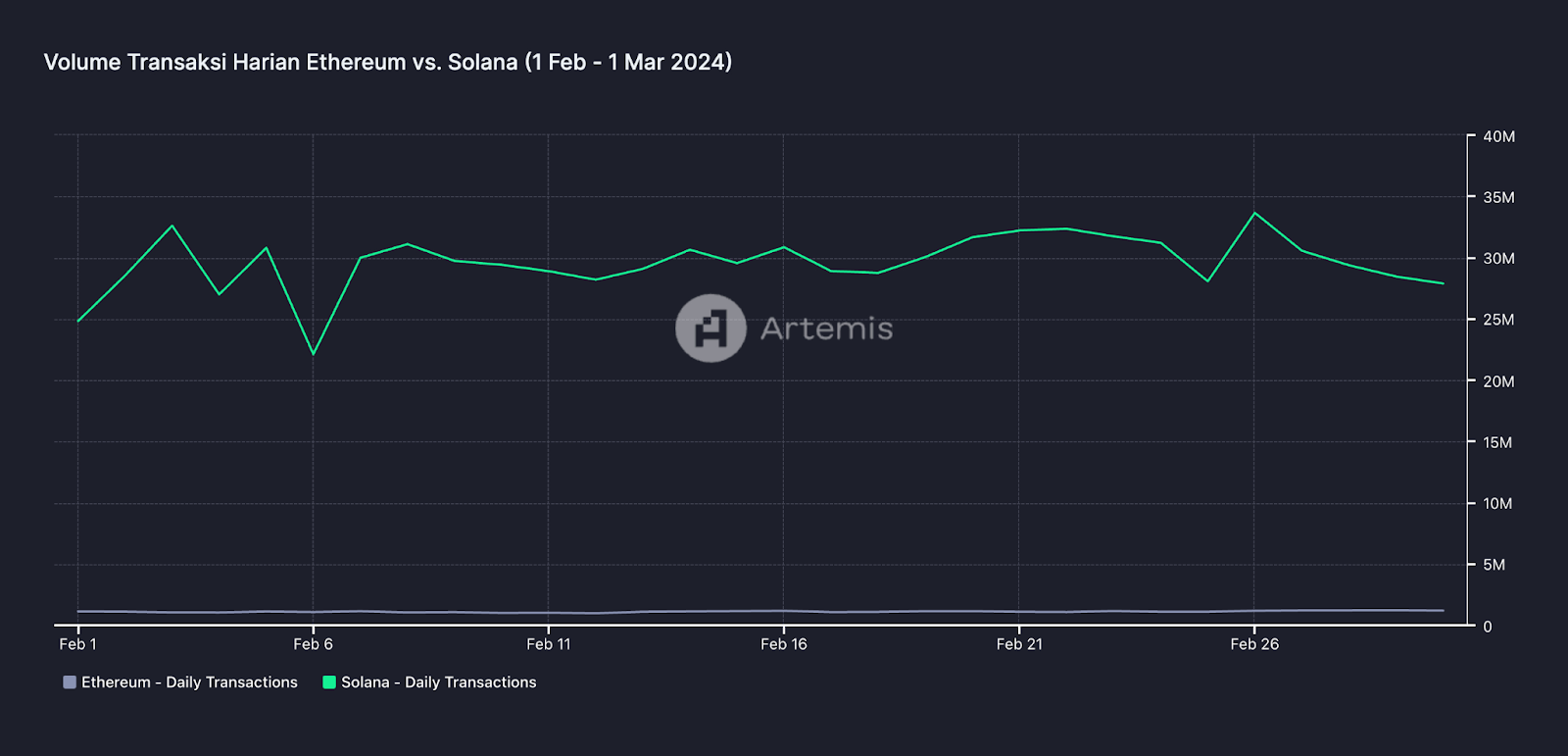

The two graphs below also show that Ethereum (ETH) transaction fees are indeed increasing drastically compared to Solana, even though the total number of transactions taking place on the Solana blockchain is much higher.

Based on data from Artemis.xyz, Ether's total daily transaction fees or gas fees on March 1 2024 reached $21.6 million, while Solana only reached $371.1 thousand.

Referring to data from Artemis.xyz, Solana's total daily transaction volume on March 1 2024 actually reached 27.9 million transactions, while Ethereum (ETH) only reached 1.2 million transactions.

The increase in Ethereum (ETH) gas fees is indeed beneficial for investors who hold this crypto asset, but this success could backfire in the future if high gas fees are not balanced with adequate innovation.

It would not be surprising if in the next few years, more and more decentralized application (DApp) developers will leave Ethereum (ETH) to move to other smart contract blockchains that offer more affordable transaction fees.

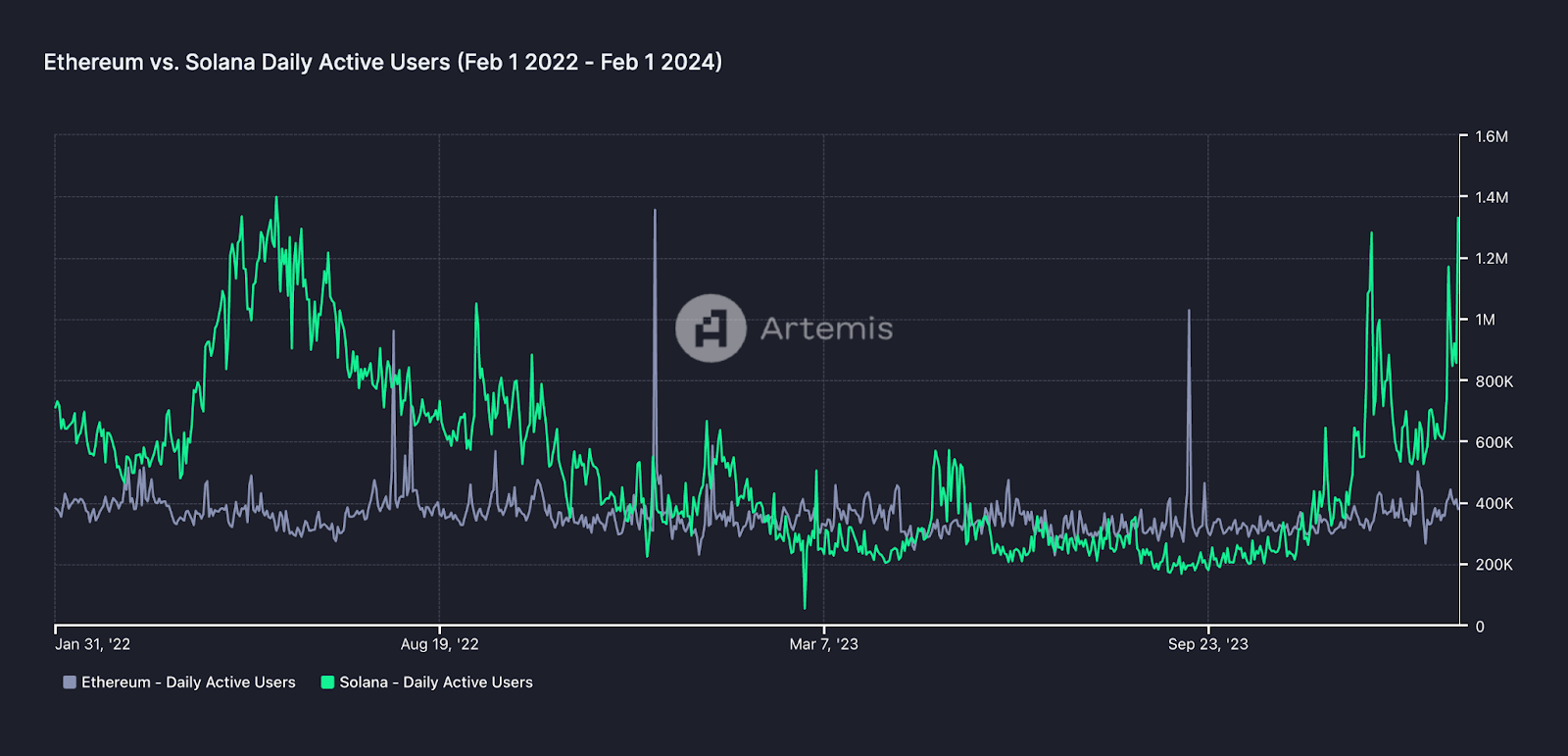

This can even be seen over the last two years, as seen in the drastic difference in active user growth between Ethereum (ETH) and Solana (SOL) in the 2022-2024 period.

As reported by Artemis.xyz, on February 1, 2022, ETH's total daily users amounted to 377.9 thousand, while SOL amounted to 731.4 thousand, however on February 1, 2024, ETH's total daily users decreased to 374.4 thousand (-0.93% from 2022), while SOL increasing to 1 million (+36.7% from 2022).

Ethereum Dencun (Deneb + Cancun)

The Ethereum (ETH) challenges described above are indeed old stories that are well understood by the development team at the Ethereum Foundation.

Despite this, no significant action has been taken by the Ethereum Foundation to implement features that could reduce it gas fees; The 2022 Ethereum The Merge (Paris) upgrade only had an impact on energy efficiency but had no impact on transaction fees.

The appearance of two new upgrades which will be released on March 13 2024, Deneb and Cancun, will change the current status quo.

Several new features will appear in the Dencun upgrade—an abbreviation for these two latest upgrades—will create gas fees Ethereum blockchain is reduced significantly especially for Ethereum L2.

Some important points of change that will be present in the Dencun upgrade, as outlined in the Ethereum Improvement Plan (EIP), are as follows:

1. EIP-4844: Proto-Danksharding

This new feature aims to improve scalability Ethereum by managing large amounts of data more efficiently. Typically, all Ethereum transaction data is stored permanently on the blockchain.

However, this new approach—known as the transaction-based approach blobs—introduces a way to include large blocks of data in transactions without needing them to be stored forever.

With proto-danksharding, the Ethereum team estimates that Ethereum blockchain gas fees, especially L2, for certain types of data transfers, will be drastically reduced—even lower than the fees charged for data transfers on the Ethereum blockchain network using ZK-rollups.

Need to know that Ethereum's own ZK-rollups gas fees are around 40-100 times cheaper in comparison gas fees The most basic Ethereum. This fee change could help increase the use of the Ethereum blockchain network especially for DApp development into the gaming sector.

2. EIP-4788: Reduce External Oracle Dependencies

Currently, Ethereum still relies on external blockchain oracles for smart contracts to access the consensus state of its blockchain. However, with EIP-4788, Ethereum will provide direct access to the underlying Beacon Chain blockchain at its execution layer.

With this, both users and Ethereum itself can know the state of consensus at any time without needing to go through data from external oracles.

3. EIP-7045, EIP-7044, and EIP-7514: System Optimization

These three EIPs together play a role in optimizing the cycle and operation of validators on the Ethereum blockchain network. EIP-7045 extends the maximum slots to include validator attestations in the Beacon Chain, while EIP-7044 simplifies the exit process for validators and ensures their actions remain valid in the future.

Additionally, EIP-7514 limits the number of Ethereum blockchain validator activation turnovers to 8 per epoch, which helps keep the validator set size stable and well-managed.

Launching Ether Spot ETF

It's not just Bitcoin that's being launched in the form of a spot ETF; Ethereum is also planned to be released in this form in 2024.

The release date is fixed still uncertain because the United States Security Exchange Commission (SEC) is still reviewing the permits for this commodity.

However, several well-known firms and investment management companies that also release Bitcoin spot ETF products, such as BlackRock and Grayscale, have already developed their respective Ethereum spot ETF products and are ready to launch them as soon as the SEC gives a signal.

The release of the Bitcoin spot ETF succeeded in pushing the price of Bitcoin to its highest price since it was first released to the public, and crypto observers such as Juan Leon in Bitwise and Geoff Kendrick in Standard Chartered speculating that the same thing could happen to Ethereum when the Ether spot ETF is finally legalized.

However, on the other hand, some parties are skeptical that the Ether spot ETF will be able to be sold to the public in the near future, seeing the concerns of important observers such as JPMorgan and S&P Global There is a risk of investors' money being too concentrated in certain blockchain validators which could impact the liquidity of Ether spot ETF assets in the future.

If this problem cannot be resolved, there is a high possibility that the Ether spot ETF will not be released this year.

Ethereum Preferred Investment Steps Based on 2024 Momentum

Below we will discuss the opinions of several crypto analysts and observers regarding various types of general crypto investment strategies for Ethereum based on the current condition of the crypto currency, and based on future predictions.

Buy and Hold (HODL)

Considering Ethereum's status as one blue-chip crypto, price movements tend not to be as drastic as crypto coins such as BNB or other tokens.

Therefore, HODL is often the strategy of choice for this crypto currency, and even in 2024, this position will still be considered valid.

This opinion is also supported by Expert analysts at TradingView, Mihai_Iacob, which stated on March 7, 2024 that ETHUSD is in a consolidation phase based on indicators accumulation/distribution (A/D).

Additionally, Ether coin prices tend to be moderate trending Daily price increases and decreases tend to be quickly bought by other investors, thereby pushing the price to continue to rise—which, according to Mihai_Iacob, does not happen with Bitcoin.

As reported in Coin Telegraph, Brian Russ, Managing Director of BMO Financial Group Colorado also conducted a comprehensive technical analysis of Ethereum and believes that Ethereum's value in the current market is about right; No overvalued nor undervalued, and still has the potential to increase quite drastically—up to 17 times—in the next few years.

Dollar-Cost Averaging

Some well-known YouTube crypto analysis such as Benjamin Cowen who actually tends to be skeptical of ETH, argues that Ether has the potential to surpass Bitcoin in the long term, and recommends investors who already hold Ether to stick to dollar-cost averaging to increase its assets.

In the same video, Benjamin Cowen also believes that the value of ETH tends to be sensitive to the condition of the United States economy, so that bad news about company performance on the stock market and the unemployment index will tend to affect Ether's performance on the market.

When the United States implements quantitative tightening (QT) due to inflation in the United States, the price of ETH fell drastically in the 2022-2023 period.

Of course, for those who have a long-term vision in investing in Ethereum, the recent price drop is a golden opportunity to implement dollar-cost averaging.

Even though as of March 2024, the price of Ethereum has soared far from its condition in 2023, dollar-cost averaging is still recommended as a mainstay investment strategy for long-term investors.

Arbitrage

Cross-asset arbitrage could be one strategy that can be used by cryptocurrency holders who own Ethereum assets and other tokens that also operate on the Ethereum network to reap more profits.

This opinion is quoted from the latest video from CoinBureau entitled “ETH Layer 2s READY TO PUMP!? Watch These Coins!!”, which states the potential that Arbitrum (ABR), Optimism (OP), Immutable (IMX), and Polygon (MATIC), will experience significant increases in value along with the implementation of the Ethereum Dencun upgrade which will help reduce gas fees on L2.

Based arbitration spots Inter-platform crypto buying and selling, such as between Bybit and Etoro or between MEXC and BingX, also still has the potential to reap short-term profits.

If you have accounts on more than one crypto trading platform, there is still the opportunity to take advantage of the price difference between several platforms for the same asset pair.

However, keep in mind that this type of arbitrage is now very competitive so you have to be careful in monitoring changes in the price of the targeted ETH asset on each platform.

Trading

Generally, making significant profits by daily trading ETH tends to be more difficult than Bitcoin (BTC) or other crypto coins and tokens, especially because its performance in the market tends not to experience significant spikes from day to day.

Current conditions are even more unfavorable than usual, considering Ethereum's upward momentum in the current market.

Considering the analysis from Mihai_Iacob, this trend still does not show any significant deviation.

Along with the many important events that will occur for Ethereum this year, there is a high possibility that its price will stagnate at its current high point if there are no macroeconomic changes or Bitcoin (BTC) market conditions that could cause a significant decrease or increase in the price of Ether.

CoinBureau, a crypto news channel, also stated in its article that Ethereum is more suitable to function as a crypto coin that is invested for the long term as an alternative to Bitcoin (BTC).

Staking and Yield Farming

Staking and yield farming could be an option to diversify Ethereum assets held, especially by long-term investors who want short-term returns.

Since Ethereum migrated to a validation mechanism proof of stake from proof of work in 2022, users who participate in securing the network by “staking” their tokens will earn rewards from the protocol.

Validators also receive a reward known as a priority transaction fee as an additional incentive to include user transactions in future blocks.

In general, Ethereum staking rates, namely the practice of storing and validating crypto transactions to earn rewards, typically range from 3 to 5% per year.

These profits tend to be relatively stable despite Ethereum price fluctuations in the very dynamic crypto market. However, factors such as the total amount of Ethereum staked and the level of participation in the network can also influence the rate of return.

Below are our Ethereum investment recommendations compiled based on analysis from various well-known global cryptocurrency sites, communities, companies and observers.

However, please remember that the data presented above should only be used as additional information in making your investment decisions, and is not the main guide.

We do not guarantee profits or are responsible for losses that may be caused by the following article. Happy investing!

Just starting to get involved in the world of crypto? Or are you planning to create several accounts on several well-known crypto buying and selling platforms? Use our code to get a bonus when you sign up!

|

BEST CRYPTO EXCHANGE IN INDONESIA |

||||

|

4.9

(One of the best crypto trading platforms) |

0,10%-4,5%

(Based on payment method) |

There are no promotions at this time | Start Trading

(Promotion code:KLTH9WES) |

|

4.7

(Established and reliable crypto trading platform) |

0,10%

(Based on specific coins) |

Get $500 bonus

(New users get promotions after registering) |

Start Trading

(Promotion code:QBSTS25N) |

|

4.1

(Best for crypto trading) |

0,10%

(For crypto currency) |

Get 30 USDT

(When you register) |

Start Trading

(Promotion code:UYGCQS) |

|

4

(A popular crypto derivatives buying and selling platform with relatively low trading fees) |

0,1%-0,3%

(Based on maker-taker model) |

Get 50 USDT bonus

(After your first deposit) |

Start Trading

(Promotion code:I9D8D7D) |

|

3.9

(Best for buying and selling crypto) |

1%

(For crypto currency) |

Get a $10 bonus

(When you buy crypto assets worth $100) |

Start Trading

(Promotion code:3SpIoPK) |

| 3.8

(Solid and trusted crypto trading platform) |

0,00%

(Varies based on transaction type; other fees may apply) |

Get a 1,000 USDT bonus

(When the list of terms and conditions applies)) |

Start Trading

(Promotion code:mexc-DIG892D) |

|

|

3.8

(One of the best crypto trading platforms) |

0,20%

(Depends on the monthly trading volume for each user) |

Get $700 + 90,000 SHIB

(Register and get it for free) |

Start Trading

(Promotion code:zefn8223) |

FAQs

Where can you buy Ethereum?

Ethereum (ETH), which is a proof of stake based blockchain, can be purchased on crypto buying and selling platforms such as Binance, Pintu, Bybit, and many more.

How much is 1 ETH in rupiah?

As of March 15 2024, the price of 1 ETH to IDR is around 59 million rupiah.

Is Ethereum better than Bitcoin?

Both have their respective advantages. Ethereum (ETH) functions more as a decentralized blockchain platform based on proof of stake (formerly proof of work) that allows developers to build and run decentralized applications (DApps) and smart contracts. Bitcoin functions more as a transaction tool than ETH. Bitcoin has a higher price than ETH, despite the daily transaction volume

Is it better to HODL ETH or trade?

Trading ETH is suitable during times when the Ethereum price shows a high volatility trend, because you can reap significant profits by daily trading. In times when prices tend to rise, with price increases of more than 5% per day, it is better to choose to HODL.

What are ETH's long-term strategies?

If you are interested in holding ETH assets for a period of more than 6 months, it is a good idea to use dollar-cost averaging (DCA) to increase your assets periodically. The significant price changes often experienced by crypto assets, including ETH, can provide an opportunity to add assets when prices are down, to sell when they are all-time high.