New cryptocurrencies keep appearing every year, but Bitcoin is still the crypto market champion in people's eyes.

As the first cryptocurrency and also a cryptocurrency that is often considered 'gold' in the crypto world, Bitcoin's performance is always in the spotlight of many people—both good and bad news.

Fortunately, several events in early 2024 brought a lot of good news for Bitcoin which succeeded in strengthening its position in the market.

What are these events, and what investment strategies need to be implemented based on current and future conditions this year?

The following is the explanation.

Daftar Isi.

Update on Market Conditions and Important Bitcoin Events 2024

A new breath of wind can be felt for Bitcoin owners in 2024, with many policy changes and developments in the crypto world which have quite an impact on the current Bitcoin price.

As of March 13 2024, the price of Bitcoin has increased to 65,40% in one year and the price of 1 BTC even set a new record to $73,097.77; the highest figure since 2021—an era known as crypto's heyday.

This success is indeed worth celebrating, but will Bitcoin's brilliant performance continue until the end of 2024?

Even though no one can completely predict where the price of Bitcoin will go in the future, information about important Bitcoin events in 2024 can help you as an investor in determining the right next steps.

Spot Bitcoin ETFs

It cannot be denied that the significant increase in the current price of Bitcoin is partly influenced by the decision of the United States Security Exchange Commission (SEC) to authorize product creation Spot Bitcoin ETFs.

The existence of this new regulation makes it easier to access the buying and selling of Bitcoin assets—which until now could only be purchased via buying and selling platforms cryptocurrencies such as Binance and Bybit—and this has contributed to the overall increase in Bitcoin prices due to increased demand for this cryptocurrency.

It is too early to know whether Bitcoin ETF spot will outsell Bitcoin ETF futures.

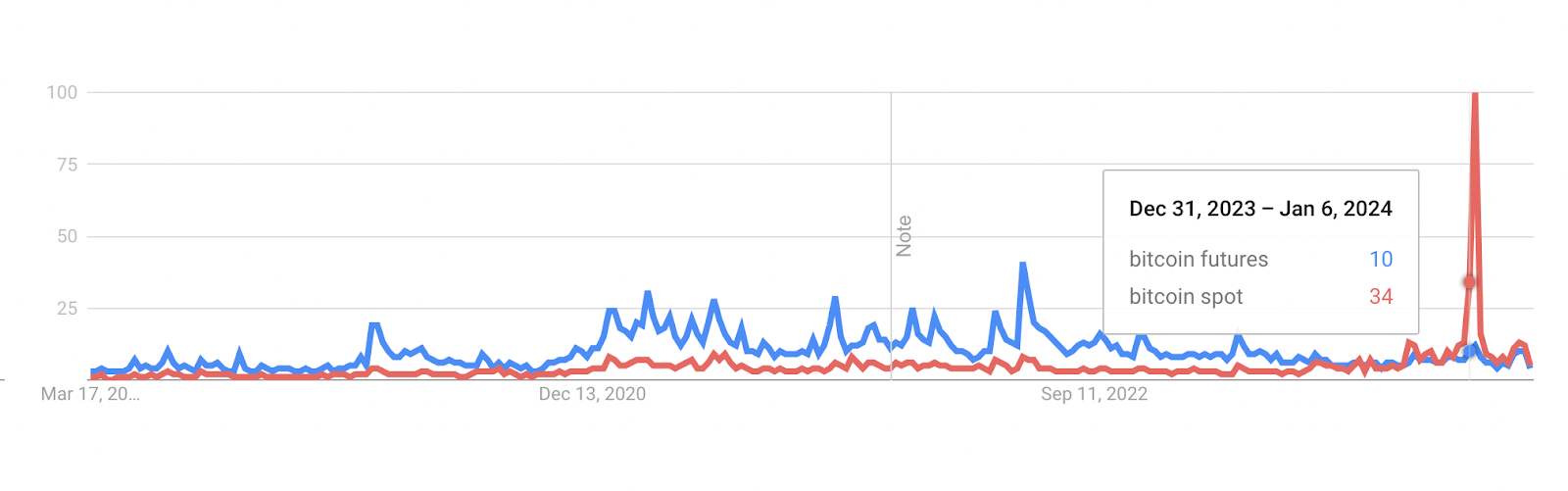

However, so far, interest in Bitcoin ETF spot is indeed much higher than Bitcoin ETF futures, as can be seen in the following Google Trends data which shows the frequency of searches for "bitcoin futures" and "bitcoin spot" during 2020 to 2024.

As of March 2024, there are 10 spot Bitcoin ETFs available on the market, namely:

- Franklin Templeton Digital Holdings Trust (EZBC)

- Bitwise Bitcoin ETF (BITB)

- VanEck Bitcoin Trust (HODL)

- Ark 21Shares Bitcoin ETF (ARKB)

- iShares Bitcoin Trust (IBIT)

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- WisdomTree Bitcoin Fund (BTCW)

- Invesco Galaxy Bitcoin ETF (BTCO)

- Valkyrie Bitcoin Fund (BRRR)

- Grayscale Bitcoin Trust (GBTC).

Net fund inflows on spot Bitcoin ETFs have been successful reached 1 billion dollars in a matter of a few months.

Based on this information, renowned observers from JPMSecurities and JP Morgan agree that the flow of new net funds into spot Bitcoin ETFs will continue to increase to 62-220 billion in 2-3 years, which will help increase capitalization Bitcoin market up to 25 times from now on.

Fourth Bitcoin Halving

The release of a new type of Bitcoin ETF is not the only important event that can impact the price of Bitcoin.

The fourth Bitcoin halving is also waiting in sight and is predicted to occur in April 2024.

As Bitcoin owners know, the total circulation of Bitcoin in the market has been determined since its first release cryptocurrencies This is 21 million coins.

However, increasing market demand will certainly reduce the number of Bitcoins in circulation, and to anticipate this, a mechanism called Bitcoin halving has been implemented.

In short, Bitcoin halving is the process of reducing the reward given for new Bitcoin mining to half of the previous amount.

The last Bitcoin halving was carried out in 2020 and resulted in fewer new Bitcoins, which of course caused the price of Bitcoin already circulating on the market to continue to rise along with increasing demand.

The first Bitcoin halving occurred on November 28 2012 and did not have much impact on the price of Bitcoin, because circulation of this cryptocurrency was still very minimal.

Amount rewards The Bitcoin earned is reduced from 50 BTC for each mined transaction to 25 BTC.

As reported by CoinMarketCap data, Bitcoin's second halving occurred on July 9 2016 and in that year, the price of Bitcoin rose significantly from $650.96 on July 9 to $963.74 on December 31 2016. During this time, the amount of Bitcoin rewards decreased to 12.5 BTC.

In the third Bitcoin halving, the Bitcoin reward value fell to 6.25 BTC. When this event occurred on May 11 2020, the price of Bitcoin reached $8,601.80.

Interestingly, at the end of 2020, even though at that time the world was being affected by the COVID-19 pandemic, Bitcoin managed to end the year at a price of $29,001.72.

From the data above, although of course there are several reasons that might contribute to the significant increase in the value of Bitcoin during each halving period, it cannot be denied that the price of Bitcoin tends to increase significantly each time it is halved.

Considering that the fourth halving will arrive in April, several observers such as Rob Nelson and Austin Arnold also stated that there is a high possibility that the same thing will happen with the fourth Bitcoin halving.

Increasing Bitcoin Use Cases

So far, Bitcoin is better known as cryptocurrencies which has high value but not much real use compared to its rival, Ethereum.

However, several blockchain developments in 2023 and this year will help expand Bitcoin's use cases, including making it a blockchain that can support NFTs—which have so far relied more heavily on cryptocurrencies based smart contracts such as Solana and Ethereum.

Bitcoin-based NFTs have become easier to create thanks to the development of the Ordinal platform, which creates Bitcoin NFTs by embedding data such as images, videos and more to one satoshi on the underlying Bitcoin blockchain.

In fact, Ordinal is not the first Bitcoin NFT platform, however, unlike its predecessors, NFTs created with Ordinal do not lie on a separate layer from Bitcoin, but instead use a system that assigns a unique number to each Bitcoin satoshi. Therefore, NFT ordinals are completely derived from Bitcoin.

Another key to Bitcoin's innovation also lies in the development of layer-2 (L2), which was pioneered by protocols such as Lightning Network, Liquid Network, and Root Stock.

L2 could be an opportunity for Bitcoin to become more widely used because it can help speed up transactions on the Bitcoin blockchain and also reduce transaction costs.

Understanding Bitcoin Market Dynamics: Best Steps for Investment in 2024

Bitcoin (BTC) is currently in price position all-time high, But how long will the condition last?

Nothing is certain in the world of investment, but several BTC developments that are and will occur in 2024 will certainly influence the investment steps you take.

Here we present some general insights about BTC investment and some information that can help you make decisions that suit your investment strategy crypto You.

Buy and Hold (HODL)

Investors who have been HODLing Bitcoin (BTC) are certainly making big profits - the problem is, are they still HODLing or selling while it is going up? Although this decision comes back to your investment targets, some analysts crypto have different opinions on this matter.

Benjamin Cowen, one of the well-known Bitcoin (BTC) analysts, recently released a video which discusses in depth about HODL waves, which is a graph that shows the age of a BTC asset based on data blockchain.

This age is determined from the date of purchase of Bitcoin (BTC) assets by an investor. In the video, Cowen found that most long-term investors—or HODLers—usually will not sell their Bitcoin (BTC) assets for at least 6 months and will only sell their assets when the price of Bitcoin (BTC) prints. all-time high.

While waiting for this momentum, HODLers will usually use dollar-cost averaging (DCA) to increase the amount of their Bitcoin (BTC) assets when prices fall or stagnate. Does that mean you need to do the same?

Of course this comes back to your considerations. However, keep in mind that every Bitcoin (BTC) price increase cycle is usually accompanied by a significant price decrease.

If you really want to make a profit now, there's no harm in selling your assets—then buying more Bitcoin (BTC) when the price decreases.

Dollar-Cost Averaging (DCA)

Is DCA still a suitable Bitcoin (BTC) investment strategy for 2024? Several observers crypto have different perspectives.

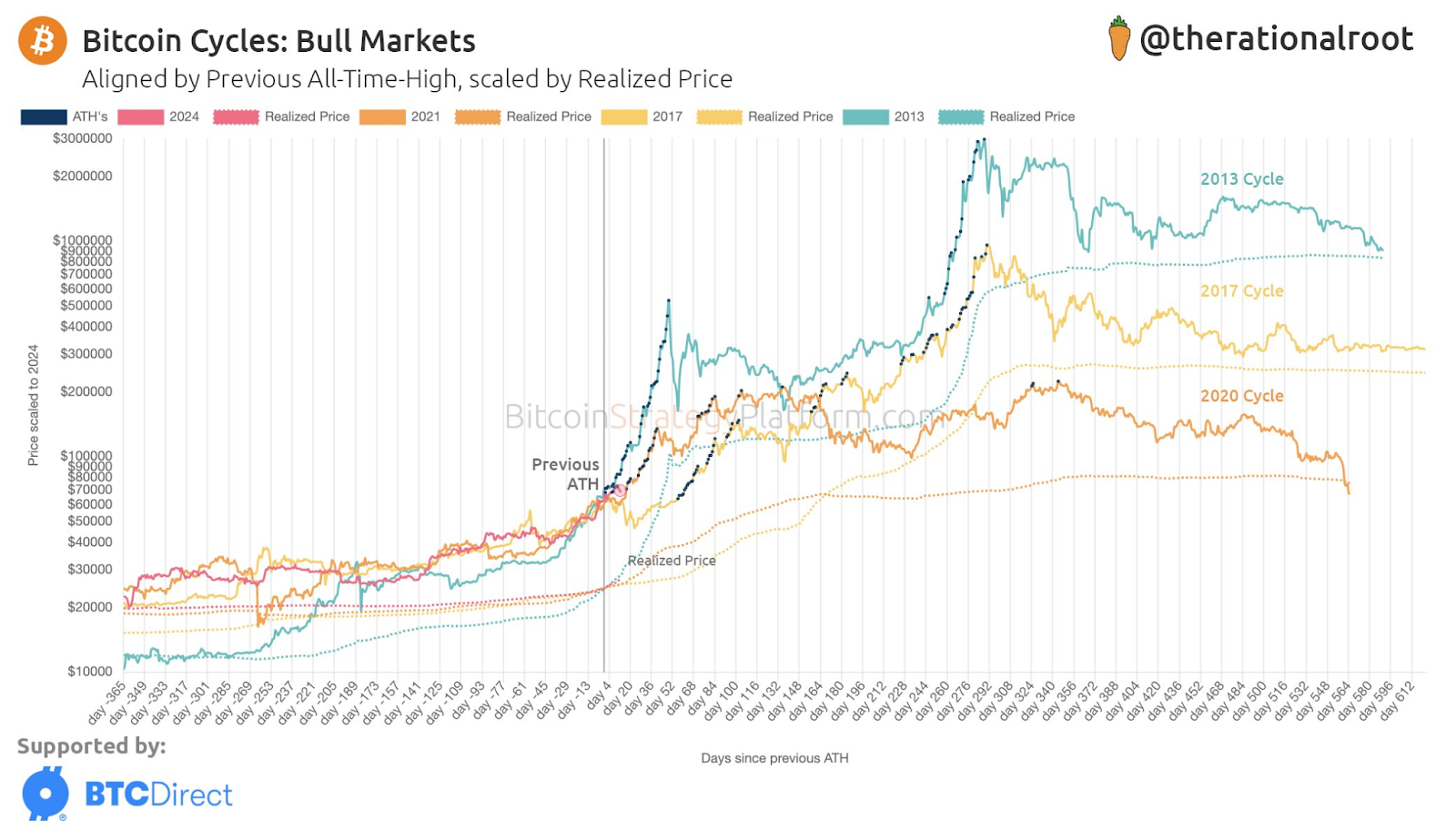

Analyst InvestAnswers supports recent insights from The Rational Root released graphic photos which shows that there is a high possibility that Bitcoin (BTC) will still experience drastic price increases in the next few months if you look at the historical data of Bitcoin (BTC) once every four years, as depicted in the graph below.

After all-time high occurred in 2013, 2017, and 2020, Bitcoin (BTC) experienced short-term price stagnation (approximately 3-4 months) which was then followed by a drastic increase. This of course makes DCA one of the strategies that benefits from the existence of this pattern.

Investors crypto only need to enter funds regularly during short-term stagnation periods, and will be able to reap additional profits from the difference in buying and selling prices when Bitcoin (BTC) skyrockets again in the same year.

Arbitrage

Arbitrage It is indeed quite complex for Bitcoin (BTC), considering that unlike Ethereum, there are not many tokens crypto created on the Bitcoin (BTC) blockchain.

So therefore, arbitrage that can be used is platform-based, by taking the difference between buying and selling prices on several buying and selling platforms crypto, like Binance and Coinbase, all at once.

This is actually still possible considering that Bitcoin (BTC) price movements tend to fluctuate more than Ethereum, so the opportunity for arbitrage still exists as long as the momentum is right.

Apart from that, considering the status of Bitcoin (BTC) as a mainstay asset for many users for transaction needs, there are still opportunities to do so triangular arbitrage, namely taking advantage of the price difference between three trading pairs involving Bitcoin, such as BTC/BNB → BNB/ADA → ADA/BTC.

As stated by independent analysts Mihai_Iacob on TradingView, there are several crypto which is directly proportional to its performance with BTC, for example Ethereum.

Trading

BTC, even though it counts as blue-chip crypto, tends to have high volatility at certain times which can provide an opportunity for investors to reap profits in the short term.

Trading crypto It does require more foresight than long-term investments, but for experienced investors, Bitcoin trading can be an interesting way to generate profits.

BTC has indeed reached all-time high on March 14 2024, and since that date there has been a short-term decline of up to 6,53% to a price of $68,323.00 on March 17 2024.

This decline was quite significant for traders crypto Experts may be able to reap profits from the price difference in these three days. In the end, back to you, if you have the time to monitor daily market conditions, BTC trading is still a reliable investment strategy in 2024.

Determining the right investment strategy requires a lot of careful consideration, both in terms of investment objectives and conditions real-time asset.

Both long and short term investors must consider many factors before making a decision on their assets, especially when it comes to Bitcoin which has a high asset value and significant transaction costs to buy or sell it.

The information presented above is intended as a means for investors to help make decisions; Please do not swallow it whole as investment advice. Happy investing!

Planning to register on the buying and selling platform crypto new like Kucoin and Bybit? Check the offer below and get a bonus for your first transaction:

|

BEST CRYPTO EXCHANGE IN INDONESIA |

||||

| Binance | 4.9

(One of the best crypto trading platforms) |

0,10%-4,5%

(Based on payment method) |

There are no promotions at this time | Start Trading

(Promotion code:KLTH9WES) |

| Kucoin | 4.7

(Established and reliable crypto trading platform) |

0,10%

(Based on specific coins) |

Get $500 bonus

(New users get promotions after registering) |

Start Trading

(Promotion code:QBSTS25N) |

| BingX | 4.1

(Best for crypto trading) |

0,10%

(For crypto currency) |

Get 30 USDT

(When you register) |

Start Trading

(Promotion code:UYGCQS) |

| Bybit | 4

(A popular crypto derivatives buying and selling platform with relatively low trading fees) |

0,1%-0,3%

(Based on maker-taker model) |

Get 50 USDT bonus

(After your first deposit) |

Start Trading

(Promotion code:I9D8D7D) |

| eToro | 3.9

(Best for buying and selling crypto) |

1%

(For crypto currency) |

Get a $10 bonus

(When you buy crypto assets worth $100) |

Start Trading

(Promotion code:3SpIoPK) |

| MEXC | 3.8

(Solid and trusted crypto trading platform) |

0,00%

(Varies based on transaction type; other fees may apply) |

Get a 1,000 USDT bonus

(When the list of terms and conditions applies)) |

Start Trading

(Promotion code:mexc-DIG892D) |

| Huobi | 3.8

(One of the best crypto trading platforms) |

0,20%

(Depends on the monthly trading volume for each user) |

Get $700 + 90,000 SHIB

(Register and get it for free) |

Start Trading

(Promotion code:zefn8223) |

Bit Coin Prices FAQ

What is the current price of 1 Bitcoin?

The price of 1 Bitcoin changes over time, but the last available data, on March 17, 2024, shows that 1 BTC is worth $68,263.00.

How much is 0.01 BTC?

0.01 BTC, if referring to the Bitcoin price as of March 17 2024, has a value of approximately $682.63.

How much did Bitcoin cost when it first came out?

When it was first released to the public, 1 BTC was sold at $0.09 – or less than $1. Now, the price has increased by approximately 750 thousand percent from the initial price.

How much is 1 Bitcoin converted into rupiah?

BTC is usually traded in United States Dollars, so if 1 BTC is converted into Rupiah, you need to look at the USD to IDR exchange rate. Using data on March 17 2024, 1 BTC, which has a value of $68,263.00, is approximately equivalent to IDR 1,067,693,140, if referring to the mid-market rate USD to IDR on March 17 2024 where 1 USD is worth IDR 15,646, 6

Is it better to HODL or trade BTC?

This decision is completely in your hands, although BTC tends to be held long term (HODL) or short term (trading). Just pay attention to market momentum; is it more supportive of trading or HODL?