Bitcoin (BTC) is the most popular and widely used cryptocurrency in the world. It is a decentralized digital currency that operates on a peer-to-peer network without the need for intermediaries. Bitcoin was created in 2009 by an anonymous individual or group using the name Satoshi Nakamoto. Since then, its value and adoption have grown exponentially, reaching a total market capitalization of over $1 trillion by 2024.

Bitcoin is known for its high volatility, meaning its price can fluctuate significantly in a short period of time. This can create both opportunities and risks for investors looking to make short-term money with Bitcoin. In this article, we will cover the latest market updates and news, market analysis and strategies from experts and traders, along with suggestions and tips on investment strategies. Consulting can help you make informed decisions.

Mục Lục

Notable developments and events

The Bitcoin market is constantly influenced by many different factors, such as supply and demand, technological developments, regulatory changes, economic events, and community sentiment. Here are some of the latest news and updates you should know:

Highest price mark in history

Bitcoin reached an all-time high of US$69,000 in November 2021. This milestone was achieved after a strong rally starting in late 2021, fueled by institutional adoption, demand retail demand and innovation in the cryptocurrency sector. Some key factors contributing to this spike include:

- Launch of the first Bitcoin exchange-traded fund (ETF) in the US, allowing more investors to access Bitcoin through a regulated and transparent instrument.

- Electric vehicle company Tesla announced it has purchased $1.5 billion in Bitcoin and will accept it as payment for its products.

- The support of famous figures such as Elon Musk, Jack Dorsey, Michael Saylor and Chamath Palihapitiya, who have expressed their support and faith in the future of Bitcoin.

- Innovation and evolution of the Bitcoin ecosystem, such as the development of the Lightning Network, a second layer solution that enables fast and cheap transactions, and the emergence of new use cases, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming.

Current BTC price

Bitcoin corrects and drops to $51,000 zone on February 18, 2024. This retracement is triggered by a combination of factors, such as:

- Profit-taking and sell-off by investors wanting to lock in profits after the record price increase.

- Technical resistance and psychological barrier at $69,000, which is a difficult level to overcome and maintain.

- Regulatory scrutiny and concerns increased, especially from China, India and Russia, which have announced or implemented stricter measures to curb or ban the use of cryptocurrencies in the scope of their authority.

- Negative sentiment and fear in the markets, fueled by rumours, misinformation and FUD (fear, uncertainty and doubt).

Market analysis and investment strategy

The Bitcoin market remains vibrant and influenced by both internal and external factors. While the long-term trend shows growth potential, short-term fluctuations and upcoming events like halving (halving of mining rewards) create many complications. Here's an updated overview with new information and analysis:

Current market:

- Price range: Bitcoin is currently trading between $45,000 and $51,000, encountering resistance at $51,000 and support at $42,000.

- Volatility: Short-term volatility is expected, with the possibility of price corrections and fluctuations.

- Activities of "whale": “Whales” (large investors) can influence the market through selling, leading to temporary price drops.

- Impact of Halving: The upcoming halving (April 25, 2024) could trigger a mild sell-off followed by a bull run lasting around 528-546 days.

Investment strategy:

- Buy-and-Hold: Suitable for long-term investors who believe in Bitcoin's potential despite short-term fluctuations. This strategy requires patience and risk management.

- Swing Trading: Take advantage of short-term price fluctuations. This strategy requires skill, experience and active analysis.

- Perforation Breakout/Perforation Breakdown: Buy above $51,000 or sell below $42,000 if the trend is confirmed. This strategy requires timing and a stop loss strategy.

- Range Trading: Buy at support ($42,000) and sell at resistance ($51,000), repeat in range. This strategy requires caution and a clear exit point.

Additional information:

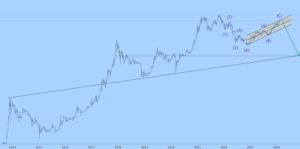

- Fractal Analysis: Predict a peak in September 2025 followed by a shift to a bearish market, suggesting an exit before September if this prediction holds true.

- Strong bearish divergence: Unresolved market tensions, likely leading to downward price pressure in a bullish widening wedge pattern.

- Technical analysis: Consistency above $42.000 suggests a potential bottom, with resistance at $47.281. A retracement to $45.500-$46.600 is likely before another breakout is attempted.

The highly anticipated halving event, scheduled for April 25, 2024, will greatly impact the market. While some experts warn of a possible pre-halving decline, others predict a post-halving price increase, which could last from 528 to 546 days. This presents a unique opportunity for strategic planning, but careful consideration is paramount.

For steadfast investors who are not affected by short-term fluctuations, a buy-and-hold strategy will be the right choice. This strategy is based on a firm belief in Bitcoin's long-term potential, requiring patience, discipline, and a solid risk management framework.

On the contrary, scalping is suitable for quick-witted investors who are good at taking advantage of short-term price fluctuations. However, mastering this strategy requires high skill, extensive experience and meticulous analysis to navigate complex market fluctuations.

Investment opportunity analysis/Investment orientation for Bitcoin

The recent boom in the cryptocurrency market, along with Bitcoin climbing to $52,000, has sparked excitement and renewed interest from investors. However, navigating this dynamic landscape requires a clearly defined strategy and a realistic understanding of growth potential and volatility. Here are some suggestions to help you orient your investment:

Short-term traders:

- Riding the wave: The recent spike to $52,000 and the prediction of an escalation to $55,000-$60,000 paint an intriguing picture. Remember, however, short-term trading requires constant vigilance and flexibility.

- Analytical skills: Hone your technical analysis skills to identify entry and exit points in this volatile market. Use tools like moving averages, relative strength index (RSI), and Fibonacci retracements to make informed decisions.

- Insurance against crosswinds: Prepare for potential pullbacks, which are common in Bitcoin's fast-paced environment. Consider placing stop-loss orders to minimize potential losses and have a clear exit strategy.

- Stay flexible: Don't be afraid to adjust your strategy as market conditions change. Be ready to adjust your trading positions based on new information and technical signals.

Long-term investors:

- Play the long game: MicroStrategy's success and overall market sentiment point to Bitcoin's long-term potential. This approach requires patience and faith in the future of technology.

- Focus on the basics: Conduct thorough research into Bitcoin's underlying technology, its economic impact, and its potential adoption. Understand the factors that drive its long-term value.

- Technical support is your ally: Although fundamentals are key, technical analysis can still provide valuable insights. Watch key support levels like the $48.000 zone and consider buying opportunities on potential dips.

- Price Average (DCA): This strategy involves investing fixed amounts at regular intervals, regardless of price. This helps average your entry points and reduce the impact of market fluctuations.

- Diversify and rebalance: Don't put all your eggs in one basket. Spread your portfolio across different asset classes, including other cryptocurrencies, to manage risk. Rebalance your portfolio periodically to maintain your desired allocation.

Be prepared for volatility:

- Potential fixes: Experts suggest a possible pullback to the $48,000 support area before growth resumes. Be ready for this potential scenario and have a plan.

- Adjust your approach: Market conditions can change rapidly. Be ready to adjust your strategy based on new information and technical indicators.

Conclude

The Bitcoin market, like a vast ocean, presents a picture full of opportunities and challenges. By understanding both short-term trends and long-term potential, you can equip yourself with the tools to navigate its dynamic waves.

For short-term traders: The current bullish trend offers exciting possibilities, but remember, volatility is always lurking beneath the surface. Mastering technical analysis and remaining flexible are vital to navigating these choppy waters.

For long-term investors: Bitcoin's fundamental strength and growing adoption point to a promising future. By focusing on the potential of technology and using strategies like price averaging (DCA), you can weather the storms and reap the rewards of the long journey ahead.

To invest in BTC, it is best to use the exchanges below. These exchanges have been tested by CryptoPie for safety, fees and many other factors

| Exchanges | Highlights | Registration link |

| Binance | Wide variety of cryptocurrencies, low transaction fees, and promotions, popular with many traders around the world. | 【V7EW8UH1】 |

| Bybit | Specializing in margin trading with high leverage, regularly organizing welcome bonuses and trading competitions for new users. | 【SSASA76】 |

| Kucoin | Rich list of altcoins, regular promotions for newly listed coins, incentives for KuCoin Shares (KCS) holders | 【QBSTASD8】 |

| MEXC | Prioritize DeFi projects, regularly reward users with airdrops, gifts, competitive transaction fees, create a vibrant community | 【mexc-K193D92】 |

| HUOBI | Offers advanced trading features such as futures and options trading, high liquidity for major cryptocurrencies and many promotions for new and old users | 【c4gn8223】 |

| BingX | The best social trading platform, allowing users to copy successful traders and offering special rewards for active participation | 【UYGCQS6K】 |

| Etoro | Allows users to follow and copy the trades of top investors, provides a user-friendly interface and a welcome bonus for new users | 【3O5diu1】 |