What is Ripple (XRP)? The cryptocurrency was created by Ripple Labs in 2012 with the aim of being a medium for fast international money transfer transactions. Ripple Labs has developed the RippleNet protocol and uses XRP as part of its technology infrastructure to enable faster, lower fees than other methods of transferring money.

XRP works differently from other cryptocurrencies because it is not mined like Bitcoin and Ethereum, but rather the total supply of coins is created once in the first place. The total amount is 100 million XRP. Ripple Labs will make XRP available as an international financial gateway on RippleNet and can be used to transfer funds between other participating countries.

This is because XRP is part of an international money transfer structure that is constantly evolving and has many users. This resulted in a higher market capitalization.

สารบัญ

Ripple (XRP) Latest news

XRP's future price has attracted a lot of attention among crypto investors and Web3 enthusiasts. that came out looking the best Because it cannot be accurately predicted. Therefore, we choose to analyze the price fluctuations of coins according to the news.

Most recently, Google Gemini had the effect of driving XRP up to $500. Gemini, Google's artificial intelligence chatbot, confirmed that XRP reaching $500 is highly unlikely. Despite the coin's potential for expansion, Chatbot notes that hitting $500 at the current circulating supply would indicate a market cap that is higher than China's GDP and may The price is too high. This is unrealistic in real world applications.

Telegaon may cause the XRP price to not reach $500 by 2050. Telegaon is a famous online coin price prediction platform. It is expected that XRP will reach $500 in 2050. According to Telegaon, XRP will end 2024 with a high of $2.28. The price prediction platform reveals that XRP will not reach the double figure until 2030, when its maximum value is $10.13.

Long-Term Ripple (XRP) Trading Planning

A trading plan is a list of predetermined price levels for executing a trade. It is an important tool in the work of traders, consisting of

- Pricing into the market

- Determining the cancellation level (Stop Loss or SL)

- Determining the price to make a profit (Take Profit or TP)

This is to manage risk and increase profits. Every trader needs to consider the break-even level and movement of digital assets in their trading plans. Modifications can be made by changing the position size. or add parameters Professional traders plan at multiple levels to optimize risk and maximize profits. The platforms where you can trade this coin are Bitstamp, Huobi Global, Kraken, and Coinbase, etc.

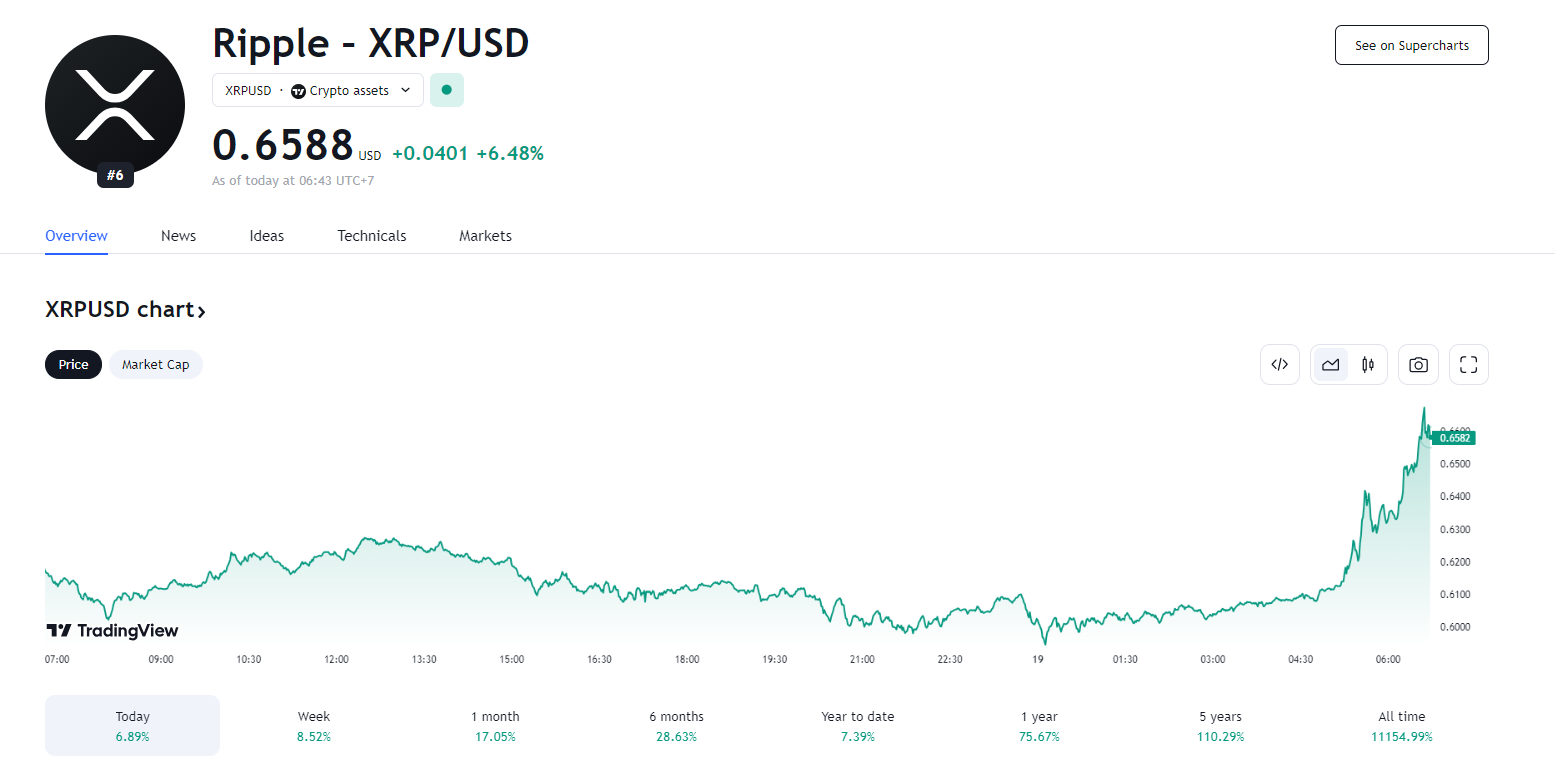

The future price of XRP is expected to return to the 0.60-0.67 USD zone in the medium term and drop to around 0.30 USD in the long term. Trading planning must take into account setting the market entry price. Setting your loss and take profit points by approaching the highest price is important. and set a clear loss point The example shows that XRP trading can be profitable with risk management and following a trading plan.

Analysis and forecast of Ripple coin (XRP)

Ripple (XRP) is definitely expected to expand in the future. If looking at the price analysis table The coin may rise higher. Although the coin does not aim to be as decentralized as possible, But it actively cooperates with international banks and investment companies. Experts say this factor could be the key to Ripple's success. XRP is not just a cryptocurrency, Ripple is designed to be a full-fledged payment infrastructure that can replace SWIFT as well.

Ripple XRP coin is one of the leading cryptocurrencies. Although this coin does not aim to be as decentralized as possible, But it also cooperates with international banks and investment companies. Experts say this factor could be the key to the success of the Ripple coin. XRP is not just a cryptocurrency, Ripple is designed to be a full payment infrastructure that can replace SWIFT as well.

Of course, the news of the SEC lawsuit became one of the most important events. That has caught the attention of cryptocurrency investors. The court proceedings began in 2020 and ended in July 2023, on the grounds that the court sided with XRP and accepted the token as a security. This court decision made Ripple (XRP) investors very happy. Because this will greatly increase the investment rate of the coin. The price of the coin increased by 100% immediately after the event. But then within a few weeks The price also dropped to the previous rate.

This proves the cryptic nature of the token. and the direction of movement of the coin The group of traders has predicted that the coin's value could rise to a maximum of more than $50. At this price level there may be FOMO and then decline due to banks. This is probably one of the XRP markets for a long time and may not participate in the second half of this uptrend from 2026 to 2030 as the United States and the world face a major revolution. and changing the structure of the financial system

Tips for choosing to invest in Ripple (XRP)

Investing in Ripple (XRP) can be profitable. But it is imperative to approach it with caution and diligence. Some tips for making money buying XRP:

- Research and understand XRP: Before deciding to invest, research XRP, its technology, use cases. and latest developments in detail Understand the factors that influence price movements

- Stay informed: Follow the latest news, updates, and announcements related to Ripple and XRP. Follow trusted sources and stay informed about regulatory changes and partnerships.

- Diversify your investment portfolio: Don't put all your money in XRP, diversify your portfolio across different assets. To reduce the risk Consider investing in cryptocurrencies, stocks, bonds, or other real estate.

- Long-term investment: Consider holding XRP for the long term if you believe in its potential. The cryptocurrency market can be volatile. But holding your investment through market fluctuations can yield significant returns over time.

- Set realistic goals: Set your investment goals and set realistic expectations. Don't expect to get rich overnight. Instead, focus on achieving stable, sustainable growth over time.

- Risk management: Invest only what you can afford to lose. The cryptocurrency market is highly volatile. and prices can fluctuate greatly. Use risk management strategies such as setting stop-loss orders to limit potential losses.

- Technical analysis: Learn basic technical analysis techniques to analyze price charts and identify possible entry and exit points. However, remember that technical analysis is not foolproof. and should be used in conjunction with fundamental analysis

- Follow market trends: Pay attention to market trends and sentiment. Analyze market data and sentiment indicators to gauge market sentiment and make informed investment decisions.

- Consider Dollar-Cost Averaging (DCA): Instead of investing in a lump sum Consider using dollar-cost averaging. Invest a fixed amount at regular intervals. Regardless of price fluctuations, DCA reduces the impact of fluctuations on your investment.

- Consult a financial advisor: Not sure about investing in Ripple (XRP) or cryptocurrencies in general? Please consider consulting with a financial advisor. They can provide personalized advice based on your financial situation. Acceptance of risk and your investment goals

Summary of trading Ripple (XRP), is it worth investing in?

Should I invest in XRP? Investors should consider the risks of tighter regulation in the cryptocurrency market, especially in 2024. Increased regulation could have a significant impact. But the market is still active and XRP/USD still has important trading characteristics, despite XRP's high volatility. But there is an opportunity to add value. If there are enough buyers Long-term investors are advised to avoid XRP due to its instability. But for active traders, they may consider XRP as the ideal trading tool for themselves. Don't forget to register for a demo account with us to trade Ripple without the risk of loss.

Frequently asked questions

Who started the Ripple (XRP) coin?

XRP was started in 2018 by Ripple Labs, which is founded by Chris Larsen, Arthur Britto, Ryan Fugger, David Schwartz, and Jed McCaleb. It uses the names Ripple Labs, Inc. and OpenCoin to develop a system for banking transactions. Reduce operational problems and reduce additional fees to be cheaper

What are the highlights of Ripple coin (XRP)?

What makes the XRP coin different and unique is that It has its own network called “RippleNet” which is an open network where assets can be exchanged in a short time. And is safe on the blockchain (Blockchain), but will only be allowed to organizations or banks that have their own networks. This can be said that Ripple transactions are made through a private blockchain or that companies within the Ripple network can order the seizure of any amount of XRP. Access to Ripple is limited to a limited number of people.

What are the differences between XRP and Ripple?

Ripple is a payment platform between financial institutions and investors. It uses P2P transactions with XRP as an intermediary for fast processing. Solve the problem of delays and fees, with the Payment Gateway service helping with other aspects of money processing. XRP coin is a digital currency used in Ripple transactions to reduce fees and speed processing. But there are differences with Ripple.

exchange Cryptocurrency Best in Thailand 2024

| Cryptocurrency exchange | score | price reduction | Click the invitation code to register. |

| Binance | 4.9 | 0.10%-4.5% | OQ74YIYH |

| Kucoin | 4.7 | 0.10% | QBSTAS47 |

| BingX | 4.1 | 0.10% | UYGCQSVU |

| BYBIT | 4 | 0.1%-0.3% | 9KEI8DW |

| eToro | 3.9 | 1% | 3S0xMp1 |

| MEXC | 3.8 | 0.00% | mexc-D94SD53 |

| Huobi | 3.8 | 0.20% | n3gn8223 |