Recently, the price of Chainlink (LINK) has experienced significant gains, breaking above the $18.00 resistance and rising above 24.33%. This has led to speculation as to whether a new uptrend may be in sight, which could target a move towards resistance at $20.00. So is LINK coin worth investing in? What is the future price trend? How should I buy it? In this volatile cryptocurrency market, investors need to pay close attention to the breakout of key support and resistance levels while carefully developing risk management strategies. Chainlink (LINK) coin price movements will be affected by a variety of factors, including market sentiment, technical indicators, and overall market conditions. Therefore, in-depth research and rational decision-making are the keys for investors to succeed in this market.

If you want to know more relevant knowledge and latest news about the cryptocurrency field, please subscribeCryptoPie. We provide the most professional cryptocurrency community services, publishing market analysis and high-quality potential currency recommendations every day, allowing you to get cutting-edge information as soon as possible!

目录表

Introduction to LINK Coin and Chainlink

hainlink (LINK) is a decentralized oracle network platform founded in 2017 and is currently the most influential on-chain oracle leader. The oracle is a service that provides data to the demand side, while price feeding refers to providing price data.

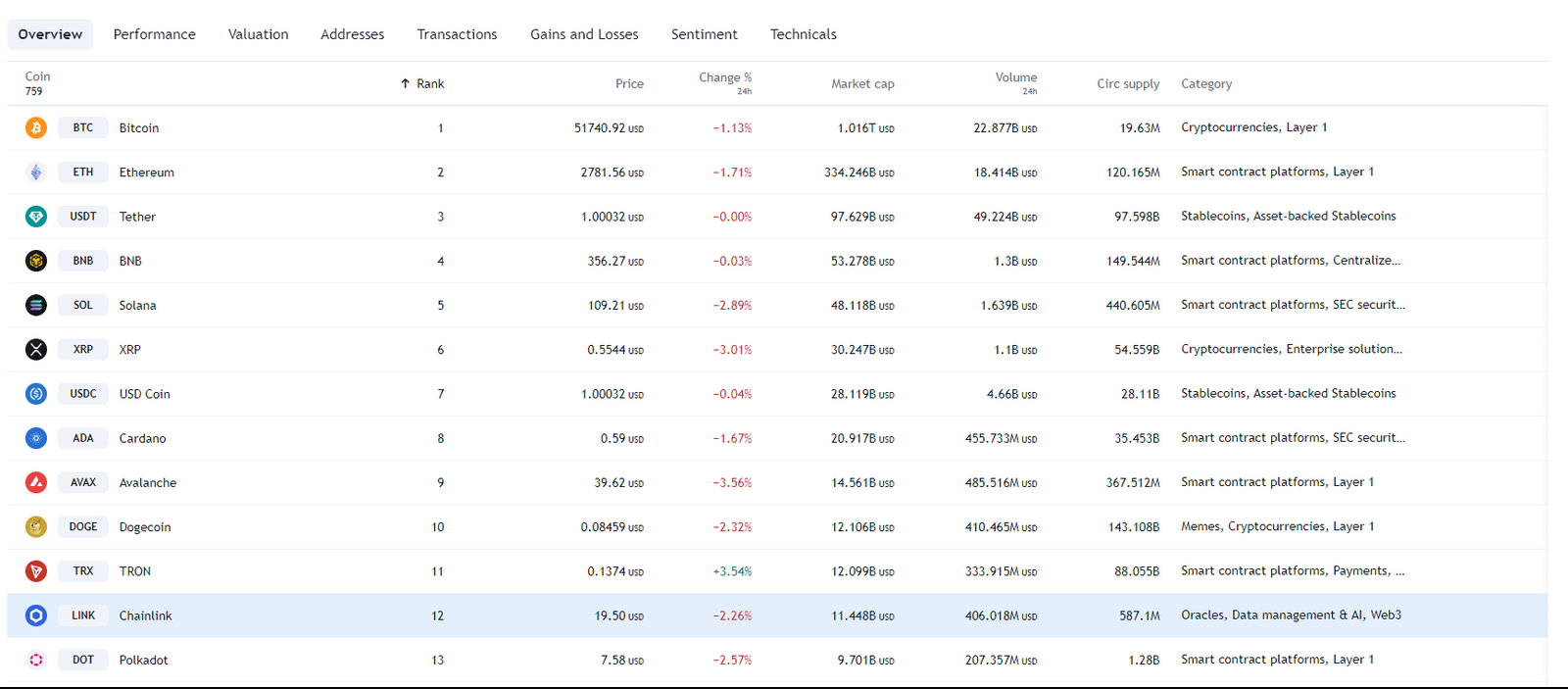

LINK is an ERC-20 token based on Ethereum, with a total market capitalization of US$4 billion, ranking 12th globally. The total supply of LINK is 1 billion, and its distribution is as follows:

| quantity | Proportion | Assign object | Use/Purpose |

| 350 million | 35% | Community | excitation |

| 350 million | 35% | investor | Fundraising |

| 300 million | 30% | Fund/Project Party | Developing Chainlink |

The LINK token has multiple uses within the Chainlink network and serves as a circulating token that connects the entire ecosystem. Suppliers can pledge LINK tokens to provide data services, demanders can use LINK tokens to purchase data, and ordinary users can also pledge LINK tokens to earn income. In short, the LINK token acts as a currency when buying and selling data.

What does Chainlink do? Why do you need an oracle?

Chainlink is unique as an oracle platform. Oracle platforms are divided into two types: centralized and decentralized. There are common problems with centralized oracles, such as sudden interruption of service by API data providers, data tampering, and single point of failure problems such as hacker attacks.

Due to the above issues, data provided by centralized oracles may lose accuracy and reliability due to single points of failure. Therefore, the adoption of a decentralized oracle system has become the mainstream consensus in the blockchain community.

Chainlink adopts a decentralized model as the oracle platform. It does not rely on a single data source, but uses multi-point collection and verification to confirm the authenticity and reliability of the external world.

Authentic and reliable data sources are an important basis for ensuring the practical application of blockchain, and are particularly important for DeFi (decentralized finance) smart contracts. According to data from DeFi Pulse, the current total size of DeFi contracts has reached $9.9 billion. Therefore, DeFi projects may suffer huge losses if there are issues with the authenticity of the data.

Is Chainlink Coin worth investing in? Are the future prospects good?

Chainlink’s LINK token, an on-chain oracle platform, has certain investment potential. As DeFi (decentralized finance) projects flourish on the blockchain, Chainlink, as a leading oracle platform, solves the key problem of interoperability with the outside world, providing real and reliable external data for smart contracts, and providing a broader platform for conditions for practical application.

Chainlink’s data service is a bridge for various DeFi smart contracts to communicate with the outside world, so as long as the DeFi market continues to develop, Chainlink and its LINK token have huge room for growth.

Here are two main reasons why Chainlink’s future is worth looking forward to:

Market demand grows

The DeFi market is still developing rapidly and requires reliable data sources to support the operation of smart contracts. As an industry leader, Chainlink has the ability to provide data services for various DeFi projects. Therefore, as the DeFi market expands, Chainlink's demand and application prospects will continue to grow.

Technology Advantages and Partnerships

Chainlink has advanced technology and strong partnerships in the oracle field. The platform adopts a decentralized model of multi-point collection and verification to ensure the credibility and security of data. In addition, Chainlink has established partnerships with several important blockchain projects and institutions, which helps further drive its influence and adoption in the industry.

Extremely developer friendly

Using the Chainlink system, a professional developer can develop a decentralized Defi project in very little time (if you are familiar with Chainlink, about 10 minutes will be enough), and smart contracts cannot be used after being uploaded to the chain. Changed properties.

This means that once developers use Chainlink as the data interface of smart contracts, it will be difficult to change it. Even if Chainlink competitors appear later, because the smart contracts on the chain cannot be changed, Chainlink cannot be changed. Replace it.

Therefore, once the chain link is connected to a project, it will firmly occupy the market, and competitors will not be able to compete with it.

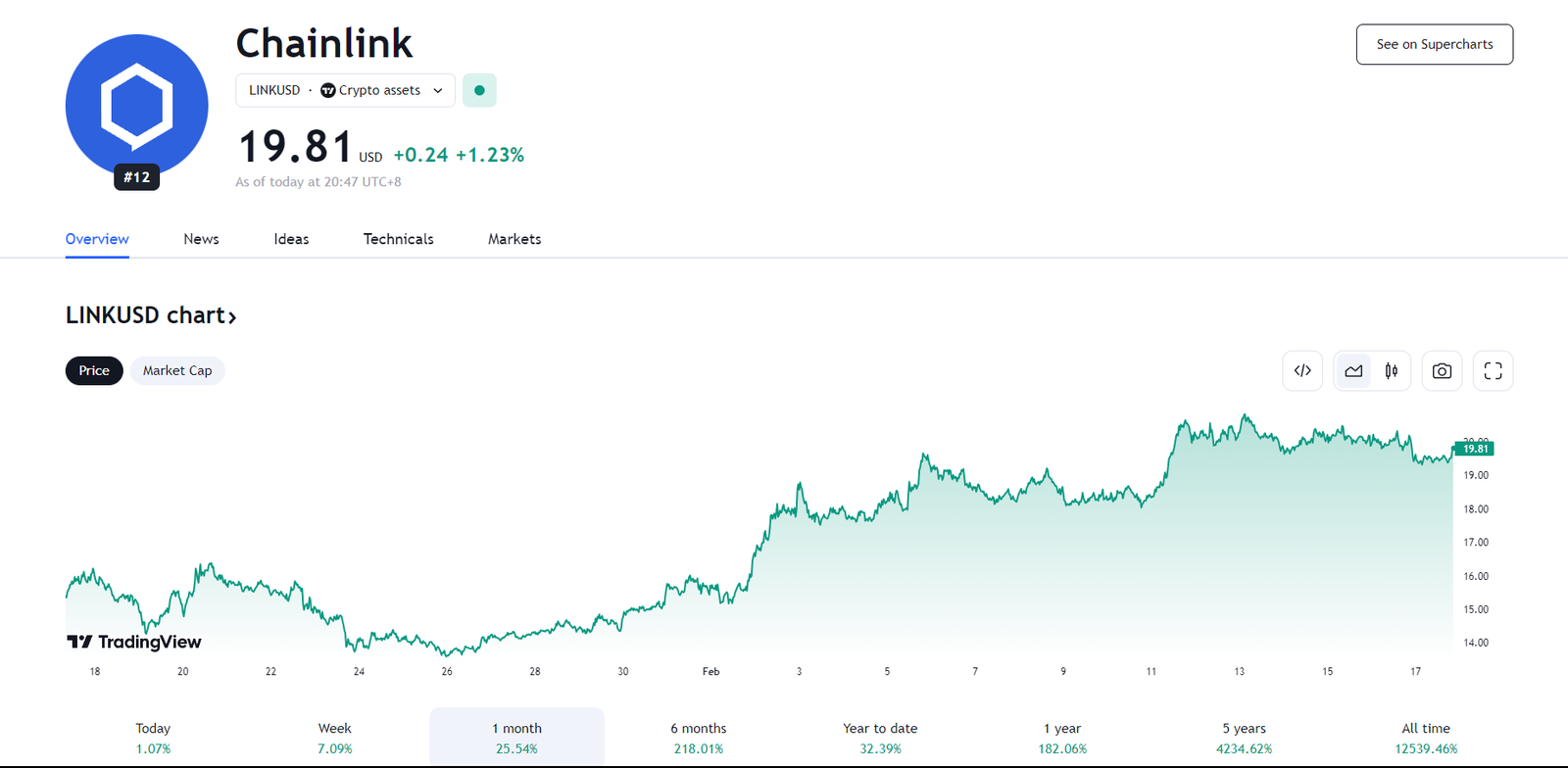

LINK coin latest price trend

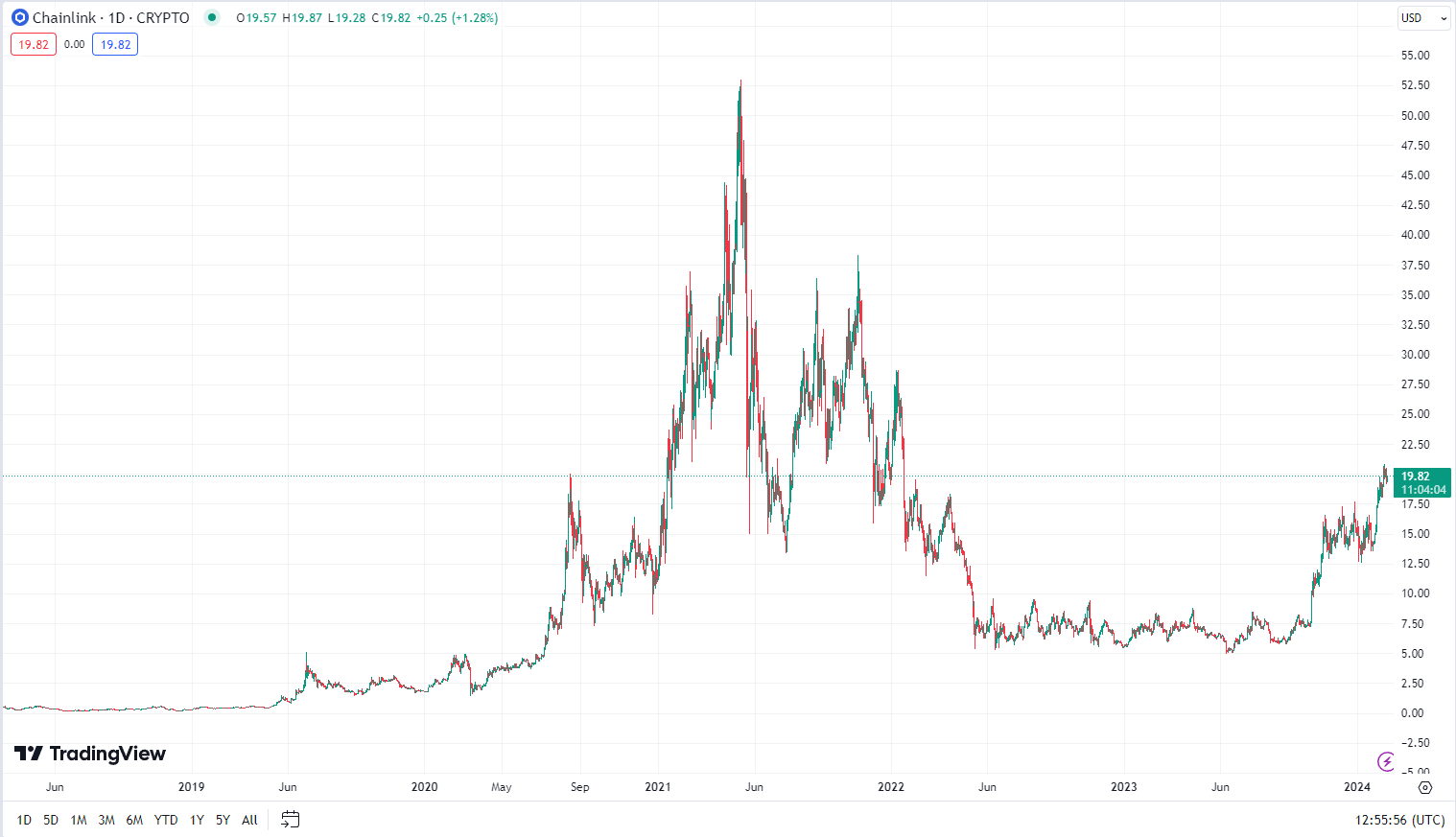

According to Trandingview market data, the price of Chainlink (LINK) currency recently surged above $15 for the first time since April 2022. It is currently trading at about $19.78, with a gain of 1.07% in the past 24 hours and a gain of 1.07% in the past 7 days. 7.09%.

As interest in LINK continues to grow, the number of wallets holding at least 1,000 LINK recently hit an all-time high of over 27,000.

How much profit can "early bird" investors get from investing in LINK?

As the native asset of the Chainlink network, the price of LINK coins is closely related to the performance of the platform. If you are interested in investing in Chainlink, it is well known that early investors have achieved considerable returns. Since its release through ICO in 2017, LINK coin has become one of the highest-returning assets in the ICO era.

The LINK coin entered various exchanges in November 2017 and is currently priced at $12, which means it has generated returns of over 10,000% for ICO investors. In terms of Bitcoin, the price of the token has increased by 1000% since the ICO. This data shows that LINK has been one of the most popular cryptocurrencies from the beginning. If you are interested in trying investing in Chainlink but don’t know how to buy it, don’t worry,CryptoPiecan help.

It is important to note that the cryptocurrency market is highly volatile and risky. Past returns are no guarantee of future performance. Investment involves risks. It is recommended to conduct sufficient research before investing and make decisions based on your own investment objectives and risk tolerance.

What factors affect Chainlink price?

Bitcoin Price Trend

Like any other cryptocurrency, the price of Chainlink is directly related to the price of Bitcoin. We can clearly see the correlation between the two when Bitcoin prices soar to new all-time highs in 2024. As retail investors poured into the cryptocurrency market, the BTC price reached $51,927 in February 2024. In this context, the prices of most cryptocurrencies with Bitcoin as an exchange target also rebounded. By February 17, 2024, Chainlink's trading price had reached $19.78, nearly 20 times higher than its ICO price.

You can see from the chart above that LINK prices soared in early 2019. However, as Bitcoin prices entered a bear market, Chainlink prices fell rapidly. However, the launch of the LINK mainnet caused its price to rebound suddenly in 2023, and by December of that year it had soared to $15, an increase of more than 4200% from the low of $0.20 in December 2018.

Dapp adoption

Chainlink’s price is also affected by the adoption of its underlying technology by Dapps (decentralized applications). If more and more Dapps choose to use Chainlink as their data source, this will increase demand for Chainlink, potentially driving the price up.

Major network upgrades and breaking news

Major network upgrades and breaking news may also have an impact on Chainlink’s price. For example, if Chainlink announces a major technology upgrade or a cooperation agreement with an important partner, this may attract market attention and drive the price upward.

Chainlink (LINK) Price Prediction for 2025

With partnerships, reserves, and popular services, LINK could reach $103.13 by 2025. However, if the market crashes, it could drop to $41.44. If smart contracts continue to process seamlessly, the average price could be $72.285.

How to invest in LINK coins?

⭐Secondary market transactions:Buy and sell LINK coins on cryptocurrency exchanges. You can register an account using a compliant trading platform, deposit funds into the account, and then exchange cash into LINK coins through the trading pair. It is recommended to conduct sufficient research and market analysis before purchasing LINK coins to understand price trends and market dynamics.

⭐Second financial management:In addition to holding LINK coins and waiting for the price to rise, you can also use LINK coins for secondary financial management. This includes participating in liquidity mining (providing liquidity of LINK coins and other tokens to obtain rewards), staking mining (locking LINK coins on a specific platform to obtain rewards), and depositing LINK coins for interest (depositing LINK coins to earn rewards) A platform that supports depositing and earning interest to earn interest). These methods can help you get additional LINK coins or other virtual currency rewards.

⭐Contract trading:Trade LINK coins by using derivatives such as CFDs. Contract trading allows you to go long or short on LINK coins and speculate based on market predictions to earn the price difference. Please note that contract trading involves leverage and risk management, and requires careful study and understanding of the associated risks.

Best Cryptocurrency Exchange Recommendations for 2024: The Best Places to Buy and Invest LINK Coins

| Best Cryptocurrency Exchange in Malaysia | score | handling fee | Bonus offers |

| Huobi | 3.8/5 | 0.20% | Get $700 + 90,000 SHIB |

| Huobi | 3.8/5 | 0.20% | Get $700 + 90,000 SHIB |

| MEXC | 3.8/5 | $0 | Get 1,000 USDT bonus |

| Binance | 4.9/5 | 0.10%-4.5% | no promotion |

| KUCOIN | 4.7/5 | 0.1% | Receive $500 bonus |

| BYBIT | 4.0/5 | 0.1%-0.3% | Get 50USDT bonus |

| BingX | 4.1/5 | 0.1% | Get 30USDT |

| etoro | 3.9/5 | 1% | Get a $10 bonus |

common problem

What is Chainlink and how does it work?

Chainlink is a node network that functions as an oracle to input off-chain information into different smart contracts.

What factors affect Chainlink price?

Like most cryptocurrencies, Chainlink follows Bitcoin’s price movements. However, the extent of this impact will depend on how many Dapps adopt Chainlink’s underlying technology. Additionally, major network upgrades and breaking news can also affect Chainlink’s price.

How can I start investing in Chainlink or trading its tokens?

You can use reliable CFD brokers like Huobi to trade Chainlink. Additionally, you can purchase its tokens through cryptocurrency exchanges such as Binance, BingX, Kucoin, Bybit, etc.

What is the purpose of creating Chainlink?

Centralized intermediary oracles are more susceptible to hacker attacks and similar security issues. To solve this problem, Chainlink introduced a network of trusted nodes so that misconduct can be punished. In other words, Chainlink solves the problems of oracle machines.

投资技巧教学.png)