In the world of cryptocurrency trading, Bybit and Binance are two well-known platforms that are popular among traders. Both platforms offer a wide range of features and services to satisfy the needs of cryptocurrency enthusiasts. However, while choosing the right platform, one must consider various factors such as features, countries of operation, security, supported currencies, fees, ease of use, payment methods, promotions, customer support, and pros and cons. In this article, we will delve into a detailed comparison of Bybit and Binance to help you make an informed decision.

Distinctive features

- In terms of spot trading, the spot handling fees of Binance and Bybit are the same, but Bybit provides more small currency choices.

- In terms of contract trading, Binance’s contract handling fees are slightly lower than Bybit, but Bybit provides more contract currency choices.

- In terms of special functions, Bybit provides more frequent voting for currency listing, LaunchPad and other activities.

目录表

Binance vs. Bybit – Elementary Rating

First, let us introduce these two exchanges so that readers can understand them better. It should be pointed out that they are very similar. However, we need to identify a clear winner and recommend to our readers which exchange to choose.

Binance is one of the largest cryptocurrency exchanges in the world. Based in Hong Kong, China, Binance leads the way in terms of daily trading volume, according to data from CoinMarketCap’s cryptocurrency portal.

Binance attracts a large number of new traders and ranks among the top in terms of number of active users, liquidity, and network traffic. Before reaching its current status, Binance started out as a cryptocurrency startup with its own currency or “native asset.”

Bybit is one of the new faces in the cryptocurrency exchange market. The exchange debuted in 2018. Bybit is an independent derivatives trading platform offering inverse and perpetual futures contracts. What's more, it offers leverage up to 1:100. Traders can also purchase quarterly Bitcoin futures contracts on Bybit, paired with Bitcoin, Ripple, Ethereum, Yuzu, Litecoin and a variety of other tokens.

Bybit also offers BTC/USD linear futures contracts with some technical advantages.

Overall, in the comparison between Binance and Bybit, Bybit ranks slightly higher, but the difference is not huge. Although these platforms have many similarities, we tend to give Bybit a higher rating.

Bybit offers a better fee structure than Binance and offers better investment plans and larger cryptocurrency bonuses. Binance is better at support, offers more educational resources, and offers traders more options for depositing and withdrawing funds.

Please refer to the table below to consider our ratings:

| characteristic | Binance | ByBit |

| overall score | 4.7 | 4.9 |

| Supervision | 3.1 | 3.1 |

| cost | 4.8 | 5 |

| trading assets | 5 | 5 |

| investment tools | 4.7 | 5 |

| Trading platform and charting tools | 4.9 | 4.9 |

| Deposits and Withdrawals | 4.7 | 4 |

| Research | 4.6 | 4.2 |

| educate | 4.8 | 4.1 |

| support | 4.8 | 4.5 |

| Promotion | 4.2 | 5 |

Comparison of trading asset types

Bybit and Binance have similarities in terms of trading options, but there are also key differences. Let’s take a look at their services in terms of trading asset types and available trading pairs and markets.

Bybit mainly focuses on cryptocurrencies, providing spot and futures trading on a variety of digital assets, such as Bitcoin, Ethereum, Litecoin, and EOS. Bybit also allows leveraged trading, allowing users to trade with more funds than they have in their account. This increases potential profits, but also increases risk.

Binance offers a wide selection of cryptocurrencies in spot and futures trading, including Bitcoin, Ethereum, and more. In addition to cryptocurrencies, Binance also supports trading of other assets such as fiat currencies (such as US dollars, euros, Japanese yen) and stablecoins (such as Tether, USDC). This makes Binance an option for traders who want to trade a variety of assets, not just cryptocurrencies. Binance also offers margin trading, which is similar to leveraged trading but has some differences.

In terms of trading pairs and markets, Bybit offers a variety of trading pairs, including Bitcoin, Ethereum, and EOS, as well as multiple markets, such as BTC/USD, ETH/USD, and EOS/USD. Bybit allows users to trade these markets using leverage.

Binance offers a wide range of trading pairs and markets, including Bitcoin, Ethereum, and BNB (Binance’s native token). Binance supports multiple markets such as BTC/USD, ETH/USD, and BNB/USD. Binance also offers margin trading on select markets, allowing users to trade with borrowed funds.

Overall, both Bybit and Binance offer a wide range of trading options, including spot and futures trading, as well as leveraged and margin trading. Bybit mainly focuses on cryptocurrencies, while Binance offers a wider selection of assets. They all offer a variety of trading pairs and markets, but the specific options may vary.

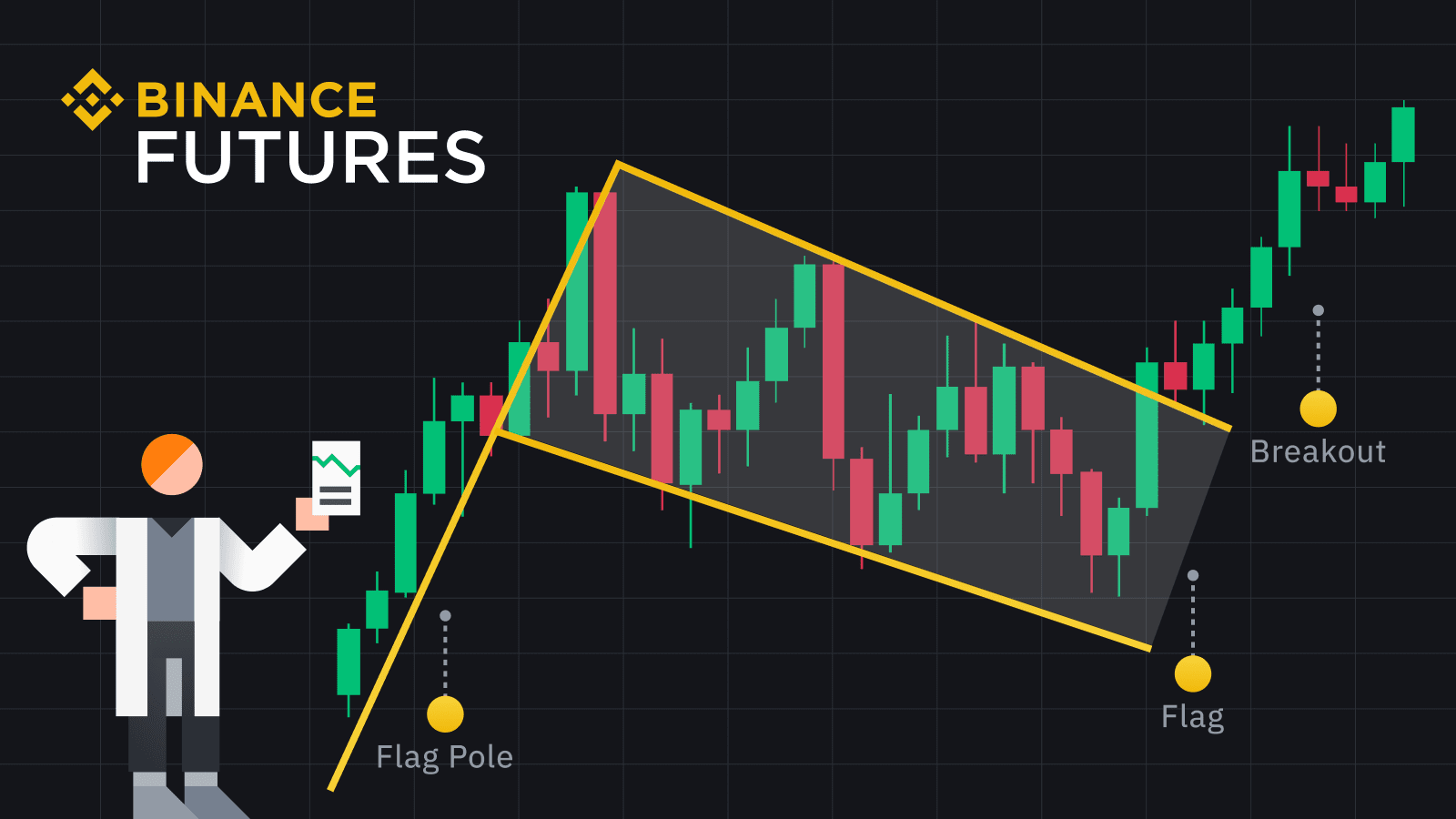

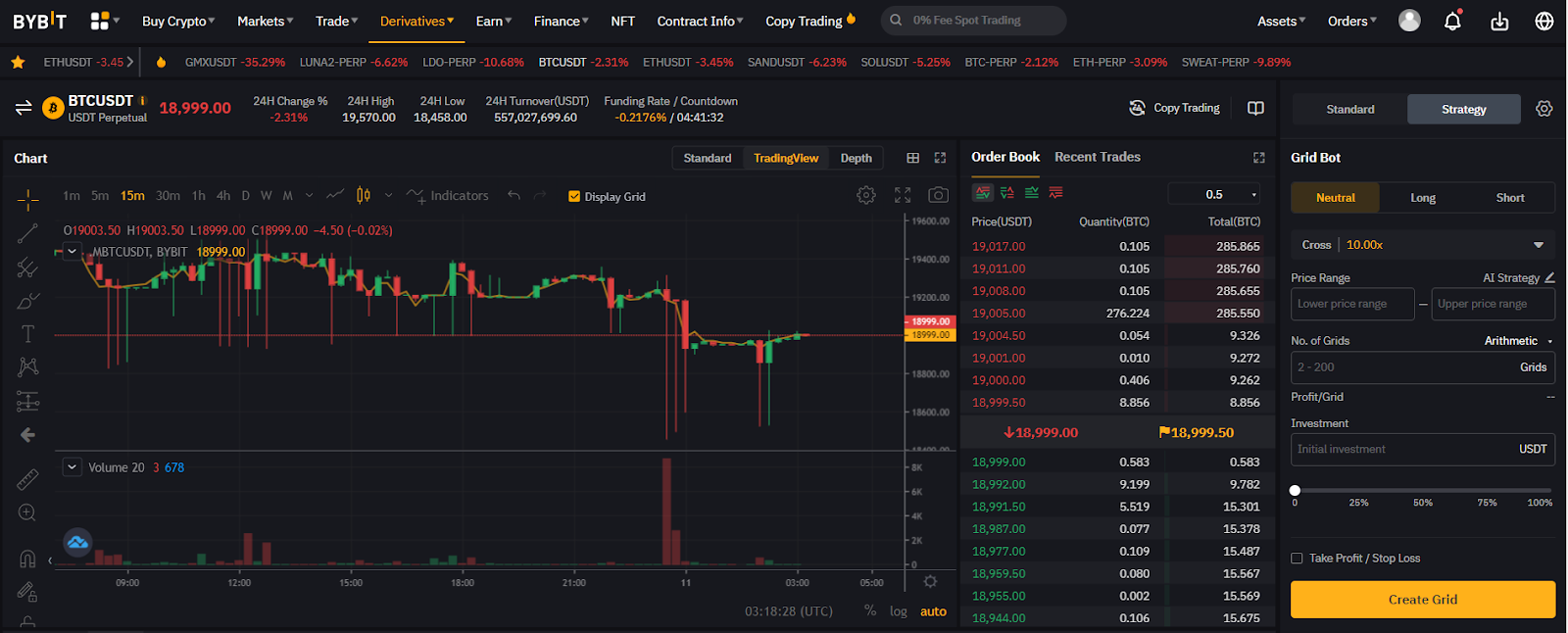

Bybit vs Binance Futures

Futures trading is a key product of Bybit and Binance, attracting a lot of attention and trading volume from traders. Bybit excels in this area, with an impressive user-friendly futures platform offering over 180 contracts. Its outstanding feature is the 99.99% server uptime, ensuring a reliable trading environment. In addition, Bybit also improves user experience through features such as copy trading and VIP programs to meet the needs of traders.

In contrast, Binance Futures is part of the larger Binance ecosystem and offers a diverse range of futures products, including 100 contracts of USDⓈ-M and COIN-M futures. While Binance offers a wide range of features, Bybit focuses on futures trading, prioritizing user experience and reliability, making it an attractive option for traders looking for a streamlined, reliable platform.

It can be seen that Bybit’s user-centric commitment and stable performance make it the first choice for futures trading.

Exchange supported countries/regions

Bybit: Bybit is available to users worldwide, except for residents of certain countries such as the United States, Canada, Iran, Syria, North Korea, and Crimea.

Binance: Binance has a global presence and serves users in most countries. However, it restricts access to residents of certain countries, including the United States, China, Iran, Syria, North Korea, and Crimea.

Security and Regulation of Bybit and Binance

Regulation and security are key when evaluating cryptocurrency exchanges like Bybit and Binance, especially when it comes to futures trading. Headquartered in the Seychelles, Bybit has made progress towards regulatory compliance and has obtained a license in Cyprus and a preliminary license in Dubai. These efforts demonstrate Bybit's commitment to aligning with international regulatory standards and take an important step on the road to global regulation.

Binance, on the other hand, has established extensive regulatory compliance across the globe. It holds various licenses and registrations in Europe, the Middle East and Asia Pacific, complies with local financial regulations, and provides services such as crypto asset exchange and custody. This extensive regulatory compliance illustrates Binance’s robust approach to aligning with international financial standards.

Overall, Bybit is actively strengthening its regulatory stance, while Binance’s extensive global regulatory compliance provides a more mature framework that may provide users with more security and trust.

Transaction fee comparison

Understanding the fee structures of cryptocurrency exchanges is crucial for traders, especially when trading futures. Here’s a comparison of fees from two major exchanges, Bybit and Binance:

Bybit fees

- Spot trading market maker fee: 0.10%

- Spot transaction bearer fee: 0.10%

- Futures trading market maker fee: 0.02%

- Futures trading acceptance fee: 0.055%

Bybit’s fee structure is characterized by simple and unified spot transaction fees. When it comes to futures trading, it offers attractive market maker fees, which is very attractive for traders who engage in high-frequency trading or focus on liquidity creation strategies.

Binance fees

- Spot trading market maker fee: 0.10%

- Spot transaction bearer fee: 0.10%

- Futures trading market maker fee: 0.02%

- Futures trading acceptance fee: 0.04%

In terms of spot trading fees, Binance is comparable to Bybit. However, when it comes to futures trading, Binance edges it out with lower underwriting fees. This is especially beneficial for traders who frequently draw liquidity from the market.

Crypto user experience

Both exchanges offer competitive fee structures, but the subtle differences between them cater to different trading styles and frequencies. Bybit maintains a balanced fee structure between spot and futures products, while Binance’s slightly lower futures underwriting fees may be more attractive to active futures traders.

In addition to security and trading options, user experience is an important factor to consider when choosing a cryptocurrency exchange. Let’s compare the user experience of Bybit and Binance in terms of user interface and navigation, customer support, and responsiveness.

In terms of user interface and navigation, both Bybit and Binance offer user-friendly interfaces that are easy to use even for beginners. Bybit’s interface is clean and intuitive, with a simple layout so you can easily find the information you need. Binance’s interface is also simple, with a tabbed layout that makes it easy for you to switch between different markets and trading options.

Both exchanges offer a variety of trading tools and features such as charting tools, order books, and trade history. Bybit offers a range of futures trading tools, including a funding rate calculator, a risk management calculator, and a stop-loss/take-profit calculator. Binance also offers a variety of trading tools, including margin trading, futures trading, and multiple order types.

Regarding customer support and responsiveness, both Bybit and Binance provide support through multiple channels, including email and online chat. Bybit also offers phone support in multiple languages. Overall, both exchanges are characterized by good customer support and responsive staff, and are well received by users.

To sum up, user experience is one of the factors to consider when choosing a cryptocurrency exchange. Both Bybit and Binance offer a good experience in terms of user interface and navigation, customer support, and responsiveness. You can choose the exchange that best suits you based on your personal preferences and needs.

Summarize

When concluding the comparison of Bybit and Binance, we can see that these two exchanges meet the needs of different traders in the ever-growing cryptocurrency exchange space.

Bybit has emerged rapidly in the futures market, providing a user-centric trading experience and making great strides in compliance. It focuses on futures trading and provides users with a wealth of trading tools and features. Bybit’s clean interface and user-friendly design make trading easy and intuitive.

Binance is known for being the largest cryptocurrency exchange by trading volume. Although it faces huge fines in the United States, its position on global regulatory fronts is stronger. Binance offers a variety of services, including spot trading, futures trading, and trading of multiple assets. It also offers a wide selection of trading pairs and markets to meet the needs of different traders.

Ultimately, choosing between Bybit's streamlined approach or Binance's extensive services comes down to personal trading preferences and requirements. If you focus more on futures trading and like a clean interface, Bybit may be a good choice. If you are more interested in variety and breadth of trading, Binance may be a better fit for you. Regardless, you should carefully consider and choose the exchange that best suits your needs.

Binance VS Bybit FAQ

Is Bybit better than Binance?

Since Bybit is the 11th ranked exchange and Binance has firmly held the number one spot for years, the general consensus is that Bybit is not better than Binance.

Binance is the leader as they offer a high-quality trading interface similar to Bybit, suitable for retail, professional, and institutional traders, but Binance offers more tradable markets and products than Bybit.

The main reasons why traders choose Bybit over Binance is that they want to join a more established community of traders, participate in their trading competitions or take advantage of some of Bybit's sign-up bonuses.

Is Bybit a good cryptocurrency exchange?

There are 10 million users on Bybit and I definitely think Bybit is a great exchange. They have a long-standing good and trustworthy reputation within the cryptocurrency community and offer one of the most reliable and high-performing trading engines in the cryptocurrency space.

Is Binance a good cryptocurrency exchange?

Binance continues to maintain 24-hour trading volume, which is more than 5 times the trading volume of the second-ranked exchange, and has tens of millions of users around the world, far ahead.

Overall, Binance is the most dominant exchange in the cryptocurrency industry because they are the best exchange. What makes Binance a great exchange is their high security, insurance of customer funds, large selection of assets and tradable markets/instruments, and the fact that they offer more products and features than any other exchange while remaining very Low fees.

Are Bybit’s fees high?

On a scale from low to high, Bybit’s fee structure skews towards the lower end, providing traders with a fee structure that is less likely to break the bank.

Bybit fees range from 0% to 0.1%, depending on the transaction volume listed on the Bybit fees page.

投资技巧教学.png)