The cryptocurrency market has experienced an astonishing growth trend in recent years. Since the birth of Bitcoin, there have been numerous innovations and developments in the digital currency space, attracting the interest of investors and traders around the world. Cryptocurrency investment strategies have become particularly important in this space. Due to the high volatility and uncertainty in the cryptocurrency market, investors need to develop smart strategies to manage risks and maximize returns.

Whether you are a novice or an experienced investor, this article will provide you with valuable insights and practical advice. Remember that the cryptocurrency market is a high-risk, high-reward area. Please be sure to conduct sufficient research and due diligence before investing, and develop a suitable strategy based on your risk tolerance and investment goals.

目录表

Analysis of strategies for investing in cryptocurrency

Without a clear investment strategy, you may be subject to emotion-driven decisions that can drain your capital. In the cryptocurrency market, fear and greed are very prevalent, causing investors to make foolish buy and sell decisions at the wrong time.

It is very common to buy over-hyped tokens at the peak of the market and panic sell when the market suffers a severe correction.

A clear cryptocurrency investment strategy can help you:

- Stick to rational, fact-based investment choices.

- Manage risk across your entire portfolio.

- Calculate the timing of market entries and exits.

- Assess whether you are on track to achieve your financial goals.

In short, a good investment plan can prevent you from becoming your own worst enemy!

Bitcoin (BTC) Investment Strategy

Bitcoin is the world's largest cryptocurrency by market capitalization, and is the world's first, most famous, and most expensive cryptocurrency. Retail investors and traders are very interested in Bitcoin's uniqueness, growth potential, and its influence on other cryptocurrencies. Bitcoin's market capitalization has reached $539,114,505,737, and its price has a direct impact on other digital assets.

According to the forecast after April 2024, Bitcoin will be traded at around $80,000. By the end of this year, the price of Bitcoin has the potential to reach $120,000. Here are the predictions for the price of Bitcoin in the coming years:

| years | Lowest price | average price | Highest Price |

| 2024 | $35,521 | $77,932 | $120,739 |

| 2025 | $62,382 | $91,203 | $148,249 |

| 2026 | $81,502 | $118,571 | $158,092 |

| 2027 | $151,109 | $161,025 | $170,720 |

| 2028 | $171,725 | $185,907 | $195,701 |

There are two common strategies to consider when investing in Bitcoin.

The first strategy: long-term holding

Under this strategy, investors will choose to buy Bitcoin at lower price levels or when the market is in a downtrend, and hold their investment for long-term benefits. The timing of selling can be based on personal investment goals, and partial or full selling can be considered when the expected long-term return target is achieved or the market enters an overheated state.

Second Strategy: Technical Analysis

Under this strategy, investors will use analytical tools such as technical indicators and chart patterns to look for price bottoms or trend reversal signals as buying opportunities. Investors will hold Bitcoin until technical indicators show that prices may reverse or show obvious volatility signals. The timing of selling can be determined based on the sell signal of technical indicators or the preset profit target.

No matter which strategy you choose, you need to conduct sufficient research and understand the market, and reasonably assess the risks. Investors should regularly monitor the dynamics of the Bitcoin market, pay attention to market trends and important events, and develop appropriate risk management strategies.

Want to learn advanced Bitcoin investment tips:A Guide to the Best Bitcoin (BTC) Investment Strategies for 2024"

Invest in Ethereum (ETH)

If Bitcoin is considered digital gold, Ethereum takes a different approach to achieving wider adoption by allowing users to create any number of custom assets and write programs that manage the operations of those assets.

Compared to Bitcoin, Ethereum's utility is more diverse. It exists not only as a medium of exchange, but also as a platform for a programmable financial ecosystem that enables decentralized applications. Ethereum's important contributions include the rise of initial coin offerings (ICOs), the widespread use of ERC-20 tokens, and the explosive growth of decentralized finance (DeFi), all of which have consolidated Ethereum's position as an important pillar in the crypto economy.

In the past, Ethereum's price performance was strong, achieving a growth of 23.93% and showing a continuous upward trend. However, the recent price trend showed some changes, which attracted the attention of investors. The market conducted in-depth research and analysis on the future trend of Ethereum to find the reasons for price fluctuations and the possibility of trends.

Solana vs Ethereum: Which One Comes Out on Top?

Which one is better, Solana or Ethereum? There is no simple answer to this question, as it depends on personal needs and preferences.

In terms of data, Ethereum is currently more influential in the market, with a larger user base and a richer ecosystem. However, Solana is developing rapidly and is expected to surpass Ethereum in the future, provided that more functions are supported.

For developers, they may be interested in the underlying technology and consensus mechanism of the blockchain. Solana is one of the fastest blockchains suitable for applications that require high throughput and low latency. Ethereum is one of the most popular platforms with a wide developer community and rich tool ecosystem.

How to invest in Ethereum and Solana to make money?

Amid market uncertainty, some investors may consider exploring newer tokens as alternatives to established cryptocurrencies such as Solana (SOL) and Ethereum (ETH). However, investment decisions should be based on individual research and risk tolerance.

- Stake your ETH: If you are bullish on ETH in the long term, you can consider staking ETH to earn passive income. Staking can be done through some exchanges or staking wallets. Before staking ETH, make sure you understand the staking mechanism, risks, and expected returns. Want to learn more about Ethereum investment strategies:Best Ethereum (ETH) Trading Strategies for 2024》

- Develop a trading plan: For active traders, it is essential to have a clear trading plan. This includes clear entry and exit strategies, risk management controls, and stop loss settings. Make sure you have a clear trading strategy and stick to it to avoid impulsive trading and excessive risk taking.

- Conducting Basic Market and Sentiment Analysis: For trading tokens like SOL, it is important to conduct basic market analysis and sentiment analysis. This involves using indicators, charts, patterns, and market signals to understand market trends and make smarter trading decisions. Top SOL Token Investment Strategies:Best investment strategy for SOLANA coin in bull market》

- Set profit targets and stop losses: Whether you are investing long-term or trading short-term, you should set clear profit targets and stop loss levels. This helps manage risk and ensures that your investment strategy is aligned with your goals.

Trading emerging currencies and potential currency markets

In the past few years, with the rapid development of cryptocurrency, many emerging digital currencies have emerged in the market. One of them that has attracted much attention is CHAINLINK (LINK) and CARDANO (ADA).

The Future of Chainlink Coin

Chainlink (LINK) tokens have shown some potential in investment. As decentralized finance (DeFi) projects flourish on the blockchain, Chainlink, as a leading oracle platform, solves the key problem of interoperability with the outside world. It provides reliable external data for smart contracts, creating conditions for a wider range of practical applications.

Chainlink's data service acts as a bridge for various DeFi smart contracts to communicate with the outside world. This enables smart contracts to obtain data from the real world, such as price information, weather data, etc. As the DeFi market continues to develop, Chainlink and its LINK token are expected to continue to benefit and have huge growth potential.

More information about LINK investment:A comprehensive analysis of Chainlink’s growth potential》

Why is Cardano (ADA) considered the next Ethereum?

ADA is a virtual currency suitable for long-term holding. It is currently ranked seventh on the digital currency rankings and shows great potential. ADA is the token of the Cardano project, which was initiated by Charles Hoskinson, co-founder of Ethereum, and others. The Cardano project aims to solve the limitations of first-generation blockchains such as Bitcoin and Ethereum, providing decentralized applications, unparalleled security and scalability, and the ability to deploy smart contracts.

The Cardano project was first conceived in 2015, and 26 billion ADA tokens were sold at $0.0024 in the ICO. The total supply of ADA tokens is 45 billion. The token is named after Ada Lovelace, an 18th-century British mathematician who is considered one of the most important figures in the early development of computer programming languages and is known as the first programmer in human history. Want to make extra money by investing in ADA coins? Learn more about Cardano:Why Cardano (ADA) has become the new favorite in the market》

How should we deal with emerging cryptocurrencies?

Before investing in an emerging cryptocurrency, it is essential to research and understand the technology, market trends, and the risks involved. Become familiar with the different cryptocurrencies available, their features, and their growth potential. You should also stay up to date with the latest news and developments in the world of cryptocurrency.

It is very important to choose a reliable exchange. Cryptocurrency exchanges are online platforms where you can buy, sell, and trade cryptocurrencies. Choosing a reliable and reputable exchange is crucial to your investment success. Look for an exchange with a good reputation, high trading volume, and security measures in place. Some popular cryptocurrency exchanges include Binance, Coinbase, and Kraken.

Diversifying your portfolio is a fundamental principle of investing. Investing in a variety of cryptocurrencies can help spread your risk and minimize losses. However, diversification should be done wisely. Invest in cryptocurrencies with solid fundamentals, strong community support, and a proven track record of growth.

Stablecoins and their market opportunities

USDT (Tether) is a US dollar stablecoin, also known as Tether. As a stablecoin, the circulation of USDT is backed by an equivalent amount of US dollar reserves, which are stored in designated bank accounts. Compared with other mainstream cryptocurrencies such as Bitcoin and Ethereum, USDT has a more stable price and is designed to address the volatility of the cryptocurrency market. Therefore, USDT can be used as a medium of exchange and a store of value, rather than just for speculative investment.

Stablecoins are designed in a variety of ways to maintain their stability, and Tether is a type of stablecoin that is collateralized by fiat currency. When 1 USDT is issued, Tether guarantees that 1 USD in reserves will be added to ensure that USDT maintains a 1:1 value relationship with the US dollar. Tether is designed to build a bridge between fiat currency and cryptocurrency and provide price stability and transparency to users.

Tether USDt (USDT) Price Prediction 2030

according toyouInputting to the Tether USDt price prediction, USDT’s value could increase by +5% to reach $1.339329 by 2030. According to the consensus rating, the current sentiment is neutral.

| Year | price |

| 2024 | $ 0.999428 |

| 2025 | $ 1.049399 |

| 2026 | $1.101869 |

| 2027 | $1.156963 |

| 2030 | $ 1.339329 |

Optimize your Tether (USDT) investment strategy and gain steady returns

The principle of Tether's interest-earning on deposits is based on smart contracts in blockchain technology. The exchange invests the Tether deposited by users in various projects, such as lending, trading, and liquidity mining, and earns profits from them. These profits will be redistributed to the users who deposited the coins, and they will receive corresponding profits based on the number of Tether they hold and the deposit period. The advantage of Tether's interest-earning on deposits is that you can earn income by holding Tether while reducing the risk of Tether transactions. The income from interest-earning on deposits is usually relatively stable and can provide a certain amount of passive income. In addition, the interest-earning on Tether deposits is also relatively convenient. Users can deposit Tether into a designated address at any time without investing a lot of time and resources like other mining methods. There is alsoAdvanced Tips for Steady Profits from Tether (USDT) Investment

The Prospects of Ripple (XRP)

Ripple (XRP), issued by OpenCoin, is a virtual currency also known as Ripple Credits. It is one of the top six cryptocurrencies in terms of market capitalization and is very popular besides Bitcoin and Ethereum. Recently, the price of XRP has seen a sharp rise, exceeding 30%, soaring from $0.47 to $0.7, and then falling back to the $0.68 level. This has sparked heated discussions in the market, with investors speculating whether XRP can continue to rise and eventually break through the important $1 mark.

Ripple (XRP) short-term trading tips and tricks

After a wave of rising prices, XRP is currently in a shock range and is close to the upper boundary of the shock zone. Based on the following basis, you can consider short-term short trading at this position:

Draw a chart of the shock zone: determine the pressure level above and the support level below. The price has risen to the upper boundary of the shock zone, that is, close to the pressure level, but the power of the bulls has gradually weakened.

The previous four-hour bar formed a shooting star with heavy volume: a shooting star appears after a rising move, indicating that the short-term uptrend may be ending, and a reversal signal appears at the resistance level, further strengthening the validity of the bearish pattern.

The last four-hour line briefly broke through the upper pressure level but failed to stabilize: indicating that there is certain pressure above.

To sum up, the above signs indicate that the short-term upward trend may be over, and the price is in a volatile range, which is suitable for short-term trading in the volatile range.

More investment strategies for XRP coins:How to invest in Ripple professionally》

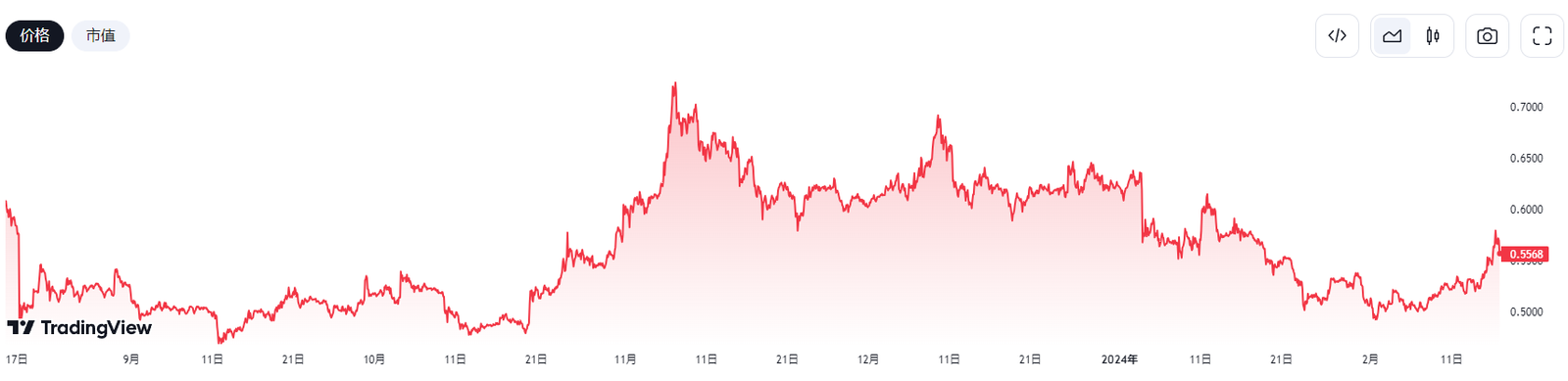

Polkadot (DOT)’s future potential

One of the main reasons for optimism about Polkadot in June 2024 is the continued growth and development of its ecosystem. Since its inception, Polkadot has established an environment that enables developers to efficiently and securely build and connect their own blockchains (called parachains).

The Polkadot network currently hosts a wide range of decentralized applications (dApps) and innovative projects, covering everything from decentralized finance (DeFi) to games and non-fungible tokens (NFTs). The increasing diversity and sophistication of these projects not only enhances the utility of Polkadot, but also increases its attractiveness to investors and users.

How to Identify the Right Time to Trade DOT in 2024

To discern the right time to trade DOT in 2024, one can do so by analyzing market trends, DOT’s price history, and upcoming Polkadot network updates. Staying tuned to reliable cryptocurrency news sources and utilizing technical analysis tools can help find the right time to trade.

For market trend analysis, you can observe the overall trend of the cryptocurrency market and DOT's performance in it. Understanding the overall market situation, investor sentiment, and other relevant factors can help predict the possible trend of DOT prices. At the same time, pay attention to monitoring DOT's price history to understand past price fluctuations and trends and draw some insights from them. When is the best time to buy DOT coins? MorePolkadotInvestment Tips:The master teaches you the time to enter the warehouse》

Summarize

Cryptocurrency investment strategies are crucial in the current market. Bitcoin is the first successful cryptocurrency, Ethereum is an open blockchain platform, and other mainstream currencies such as Litecoin and Bitcoin Cash also have investment potential. In addition, emerging currencies such as Polkadot and innovative technologies and application scenarios on the chain are attracting attention, and stablecoins have market opportunities as safe-haven assets or trading media. Investors should integrate strategies for different currencies and build investment portfolios based on risk tolerance and goals.

Thank you very much for your interest and support! I hope everyone will actively participate in the knowledge expansion in the field of cryptocurrency. You can build a comprehensive and in-depth cryptocurrency knowledge system by further reading related articles and participating in community discussions. Only through continuous learning and communication with others can we better understand the technology, market and investment strategies of cryptocurrency and make more informed decisions.

If you have any questions, please click here🔥🔥🔥【CryptoPie】💰💰💰

You can also enter your email address below to subscribe to our website and get exclusive latest articles and information.

Frequently Asked Questions and Answers

How do cryptocurrencies make money?

The main source of revenue for most cryptocurrency exchanges is trading fees. These commissions are charged for every transaction that buys, sells, or exchanges cryptocurrencies on the platform. The commission amount may vary depending on the type of transaction, volume, and user account level (for example, discounts may be offered to users with higher trading volumes). In addition to trading fees, cryptocurrency exchanges may also charge fees for withdrawing funds from the platform.

What is virtual currency?

In addition to the well-known Bitcoin, there are many types of cryptocurrencies, such as Ethereum, Monero, Dash, Ripple, Litecoin, Cardano, etc. These cryptocurrencies are of different types, some are basic cryptocurrencies, some are smart contract platforms, some are privacy coins, some are decentralized financial tokens, and so on.

What are the benefits of cryptocurrency?

8 benefits of cryptocurrency:

- Fast transaction speed

- Low transaction costs

- Availability

- Safety

- privacy

- transparency

- diversification

- Inflation Protection

Is USDT a cryptocurrency?

Tether (USDT) is a virtual currency that pegs cryptocurrency to the fiat currency, the U.S. dollar.

投资技巧教学.png)