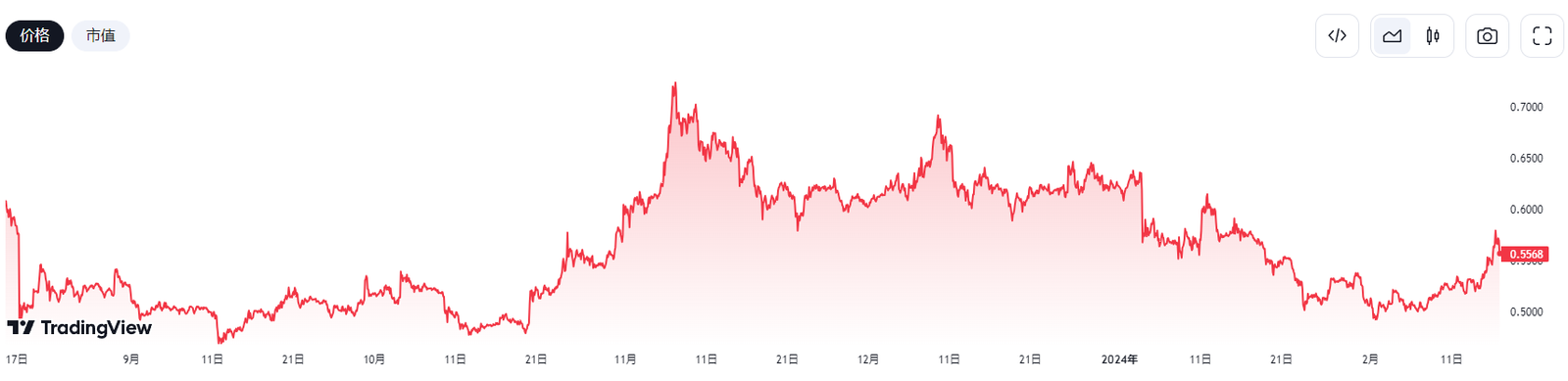

Ripple (XRP), issued by OpenCoin, is a virtual currency also known as Ripple Credits. It is currently one of the sixth most popular cryptocurrencies by market capitalization, in addition to Bitcoin and Ethereum. Recently, the price of XRP has surged more than 30%, soaring from US$0.47 to US$0.7, and then fell back to the US$0.68 level. This sparked heated discussions in the market, with investors speculating whether XRP could continue to rise and eventually break through the $1 mark.

This article will analyze the factors that have led to the rise and fall of the coin’s price, the future development trends of the Ripple network, and analysts’ predictions for the highest price of Ripple. We’ll answer questions like whether Ripple is worth investing in and where the XRP price might reach in the future. In addition, we will provide Ripple price predictions for 2024, 2025, 2026, and 2030.

目录表

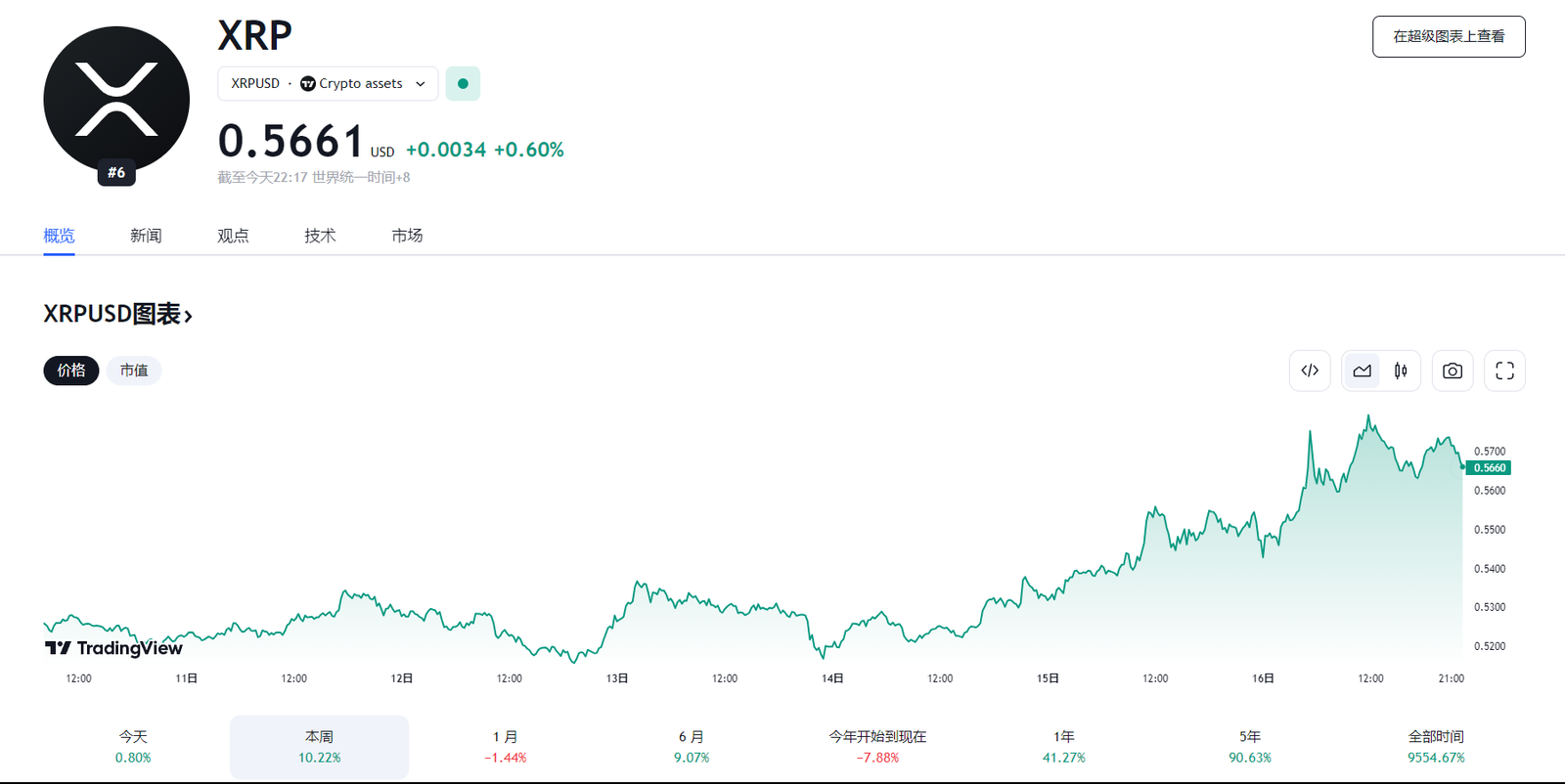

XRP Ripple Latest Price Trend

At the time of writing, the price of one XRP coin is $0.56, with a gain of 0.80% in the past 24 hours.

Here is the latest price chart of the XRP coin:

Ripple’s current circulating market value ranks sixth in the world, reaching 176.586 billion. Its maximum supply is 100,000,000,000 XRP. The current supply is 51,873,152,538 coins, and its circulating market value accounts for 2.11% of the total global market value. Ripple has been listed on 82 exchanges, with a total of 275,783 currency holding addresses.

The biggest reason driving the XRP price surge

The main reason why XRP prices have rebounded significantly is that Ripple has achieved a key victory in its lawsuit with the SEC. The SEC previously accused Ripple of illegally selling unregistered securities, namely XRP tokens, to investors. However, the judge ultimately ruled that XRP was not a security, which effectively relieved XRP’s regulatory pressure and rekindled market confidence in its prospects. This is the biggest reason for XRP’s price surge.

In addition, with the increasing expectations that the Bitcoin futures ETF may be approved, the overall atmosphere of the cryptocurrency market is gradually warming up. The recent rapid growth of Bitcoin’s total market capitalization to over 3% indicates that funds are flowing back into the cryptocurrency space. At the same time, the bear market formed by the decline in cryptocurrency prices in the past few months has gradually emerged. This sets the stage for a rally in XRP and other coins.

After XRP was previously hit by an SEC lawsuit, the price has been sluggish below $1. However, as the risk of litigation is lifted and the external market environment improves, this creates an opportunity for XRP to break above $1 again. Not only does $1 have an important psychological impact, it is also a key support level in XRP’s past price history. Once it breaks through, it will further boost market confidence and attract more capital inflows.

Of course, XRP still faces certain uncertainties in order to reach and stabilize above $1. In addition to changes in market sentiment, the regulatory environment remains complex and volatile. However, it is an indisputable fact that the outcome of the SEC lawsuit has alleviated the legal dispute and brought a positive boost to the price of XRP. Overall, as the market recovers further, it is only a matter of time before XRP breaks above $1. It has the potential to usher in new breakthroughs in the short term, bringing huge returns to many investors.

Ripple Price Prediction for 2024

Factors such as global recognition, growing adoption, and winning U.S. SEC cases are likely to increase demand for Ripple. In turn, XRP price will reach higher heights in 2024. If Ripple prevails in the institutional investment and adoption race, XRP price could reach $2.23.

On the other hand, a delay in the sentencing hearing or a slowdown in the global economy could force the price of Ripple (XRP) to fall to $1.60. Based on the XRP price range set in 2024, the average price will be $1.915.

XRP Price Trend Forecast in 2025

As the remittance market grows year by year, XRP will make the most of its gains in the cross-border payments market. Additionally, with low transaction fees and ultra-fast transaction speeds, Ripple is expected to achieve exponential growth in 2025.

The 2025 XRP price prediction places a high at $3.38 and a new all-time high with the potential rise in Ripple’s dominance. However, in the event of a global crisis such as the Ukraine-Russia war, the XRP price may remain at $2.47, which translates to an average price of $2.925.

Long-term Ripple Price Forecast: 2026-2030

What will the price of Ripple (XRP) be in 3 to 7 years? You never know what prices will do tomorrow, let alone longer-term prices. Therefore, long-term forecasts are always approximate. It is recommended that you always follow the latest news about Ripple.

To better understand blockchain projects, please follow the relevantCryptoPie's latest news, community news, and more.

СryptoPredictions

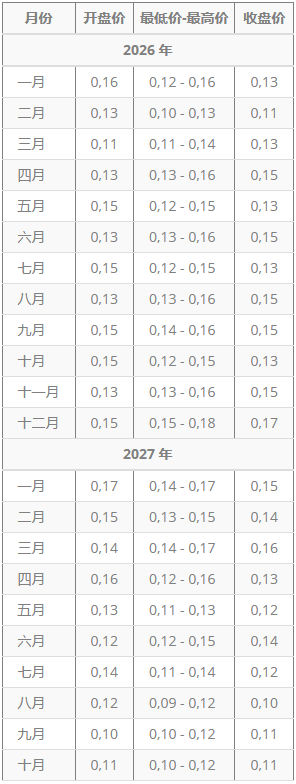

СryptoPredictions analysts predict that there will be no major price changes in the digital currency by the end of 2027. The coin price will remain within a stable range of $0.56-$0.83 in the long term. Ripple will not move beyond this range against the US dollar in the coming years. However, CryptoPredictions analysts have only provided forecasts until the end of 2027, so it is possible that the predictions for Ripple’s future price could be revised if current market sentiment changes.

Long Forecast

The economic forecaster made a prediction for Ripple’s price until October 2027. Institutional analysts expect a long-term bearish trend, with a low around $0.09.

Wallet Investor

Wallet Investor also doesn’t have a prediction for XRP’s price five years from now. Overall, company experts don’t think Ripple’s future is bright. By 2028, the maximum price of Ripple will not exceed $0.02, so platform analysts recommend selling the token.

Crypto Ground

Crypto Ground revised its predictions. Previously, analysts at the agency predicted that the price of Ripple would exceed $3 by 2027. However, revising the forecast does not mean that they are making a negative prediction for XRP price. Ripple price will continue to rise over the next five years. The coin will cross the $1 threshold in 2025. It is expected that by the end of 2028, the price of Ripple will be approximately 400% of the current price, reaching $2.27.

Is Ripple worth investing in?

The current price of Ripple in the Forex market is $0.57110.

Let’s take a look at whether you should buy Ripple (XRP). Is Ripple worth investing in? This is an important question for investors. However, I would like to remind you of some key points to help you make your decision.

First, tighter regulation will have a significant impact on the cryptocurrency market in 2024. With the active development of digital currencies and central banks and financial institutions beginning to use digital currencies, the supervision of digital currencies is increasing day by day. Especially in the United States, regulations on cash flows are increasing, which will limit the growth potential of cryptocurrencies. This factor will become even more important compared to 2017-2018. In addition, the development of decentralized finance (DeFi) is also another risk faced by Ripple.

Despite the downturn in the overall cryptocurrency market, XRP/USD remained one of the major trading pairs with good volume and volatility during the events of 2021 and early 2022. If there are enough buyers of XRP, the price of XRP could triple. However, the price of Ripple may also drop to rock-bottom levels in the short term. Therefore, if you are an aggressive trader, you may be interested in Ripple.

How to invest in XRP and what are the investment options?

Investing in Ripple (XRP) can be done in a variety of ways, here are some common ways to invest:

- Buy Spot: You can buy actual XRP tokens on centralized exchanges (CEX) or decentralized exchanges (DEX). Some well-known exchanges such as Binance and Uniswap provide such services.

- Futures contract trading: On centralized exchanges, you can choose to trade XRP futures contracts. This method allows you to buy or sell XRP at a specific date in the future at a pre-agreed price. Please note that futures trading involves leverage and risk management.

- Contracts for difference (CFD) trading: You can use the CFD trading platform to buy and sell XRP. CFDs allow you to trade on the rise and fall of XRP’s price without actually buying or holding XRP. In this trading method, you can control your risk by adjusting your leverage.

Please note that investing in cryptocurrencies involves a high level of risk and you should fully understand the market and risks and consider seeking professional advice before investing.

Risk Management for Trading XRP Contracts

Contracts may result in loss of principal

When a contract suffers a loss, it may result in a loss of your principal. However, a contract loss will only bring your principal back to zero at most and will not make you indebted unless you borrowed money to purchase the contract.

Control capital investment

The amount of funds invested in the transaction should be controlled, for example, the amount of funds invested should be limited to between 5-10% of the total funds.

Avoid excessive leverage

Based on personal contract operation experience, novices can choose contracts with no more than 10 times leverage to better control risks and reduce the risk of liquidation. Experienced investors can choose higher leverage to obtain higher returns.

Set timely take profit and stop loss

Set take-profit and stop-loss points at the appropriate time to reduce unnecessary holding time and reduce unnecessary capital costs and handling fees. This helps protect your profits and reduce risk.

Ripple (XRP) short-term trading strategy

After a wave of rising prices, XRP is currently in a shock range and is close to the upper boundary of the shock zone. Based on the following basis, you can consider short-term short trading at this position:

Draw a chart of the shock zone: determine the pressure level above and the support level below. The price has risen to the upper boundary of the shock zone, that is, close to the pressure level, but the power of the bulls has gradually weakened.

The previous four-hour bar formed a shooting star with heavy volume: a shooting star appears after a rising move, indicating that the short-term uptrend may be ending, and a reversal signal appears at the resistance level, further strengthening the validity of the bearish pattern.

The last four-hour line briefly broke through the upper pressure level but failed to stabilize: indicating that there is certain pressure above.

To sum up, the above signs indicate that the short-term upward trend may be over, and the price is in a volatile range, which is suitable for short-term trading in the volatile range.

Operational strategy

Open a short position at the current position and set a stop loss at the previous high, which is $0.534.

In short-term trading in volatile market conditions, you should wait until the price is close to the support or pressure level before operating in order to set a reasonable stop loss. If you open a position in the middle of a swing range, it will be difficult to stop the loss. Short-term trading should stop profits in time because profit margins are limited. If the stop loss space is too large, it means risking a profit equivalent to the stop loss space, which is an unwise choice.

Therefore, in short-term trading in volatile market conditions, you should conduct long transactions near the support level and short transactions near the pressure level, so that you can obtain good returns with a smaller stop loss.

A volatile market will eventually be broken out, whether it's up or down. When breaking out of a swing range, stop loss placement becomes very important to avoid getting caught on the breakout.

Ripple (XRP) FAQs

Will Ripple price exceed $10?

Anything is possible, but the likelihood of Ripple hitting $10 in the foreseeable future is slim. Only by becoming the best choice for cross-border payments by financial institutions will the price of Ripple be likely to rise. But this is a very optimistic long-term forecast.

What is Ripple’s all-time high price?

According to data from CoinMarketCap, XRP reached an all-time high on January 4, 2018, when the price reached $3.84 per XRP coin. Please check the XRP/USD online chart for the current XRP price on 16.02.2024.

What factors affect the price of Ripple?

Media coverage and the performance of the cryptocurrency influence XRP price. Ripple trends are also influenced by overall cryptocurrency market sentiment and token liquidity. Supply and demand are one of the main factors that influence the price of XRP.

Where can I buy Ripple (XRP)? 2024 Best Cryptocurrency Exchange Recommendations in Malaysia

| Best Cryptocurrency Exchange in Malaysia | score | handling fee | Bonus offers |

| Huobi | 3.8/5 | 0.20% | Get $700 + 90,000 SHIB |

| Huobi | 3.8/5 | 0.20% | Get $700 + 90,000 SHIB |

| MEXC | 3.8/5 | $0 | Get 1,000 USDT bonus |

| Binance | 4.9/5 | 0.10%-4.5% | no promotion |

| KUCOIN | 4.7/5 | 0.1% | Receive $500 bonus |

| BYBIT | 4.0/5 | 0.1%-0.3% | Get 50USDT bonus |

| BingX | 4.1/5 | 0.1% | Get 30USDT |

| etoro | 3.9/5 | 1% | Get a $10 bonus |

投资技巧教学.png)